The Coming Wave of Continuous Glucose Monitors — and What It Means for All of Us

Oct 10, 2025

Progress is impossible without change, and those who cannot change their minds cannot change anything.” — George Bernard Shaw

The CGM revolution isn’t slowing down.

It’s accelerating — and multiplying.

Ten years ago, continuous glucose monitoring (CGM) was the privilege of a few.

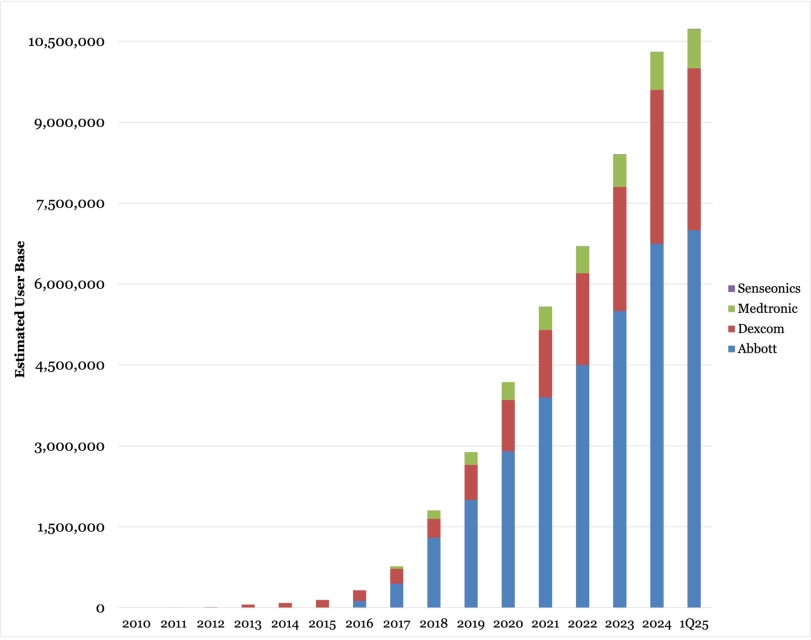

Now more than 10 million people worldwide use sensors that quietly track glucose every few minutes.

Soon, there will be dozens of models on the market — from Europe, the U.S., China, Korea, Singapore, and beyond.

The promise is clear: smaller sensors, longer wear, lower prices, and smarter insights.

But progress always brings complexity.

As more devices appear, so do new questions — about accuracy, privacy, and emotional impact.

Get Access To Updated Diabetes Technology Courses

The Expanding Field

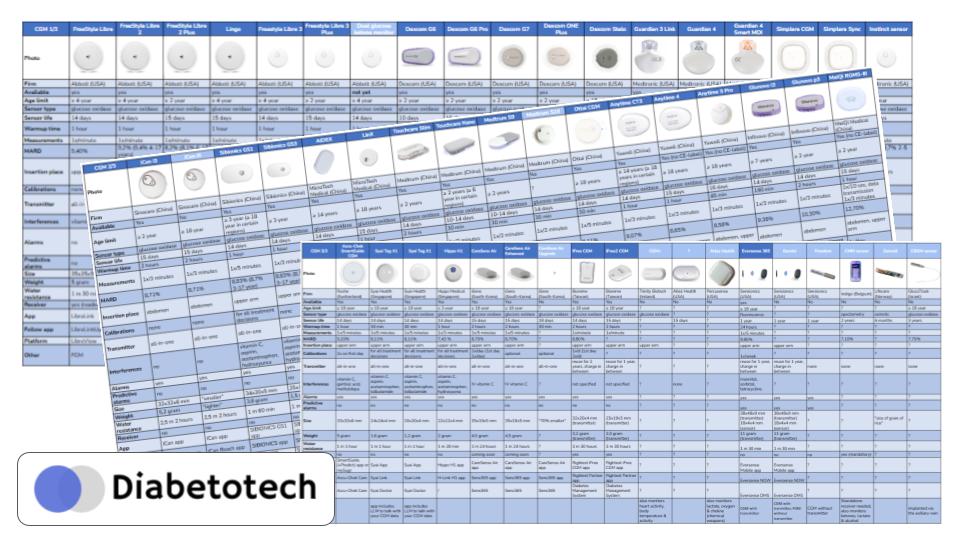

Image > Close Concerns: Estimated CGM Userbase (2010 - 1Q25)

Until recently, the CGM world was led by Abbott, Dexcom, and Medtronic.

Now, new names are entering — fast.

We’re entering an era of global competition, and that’s good news for patients and healthcare systems.

More players mean cheaper devices, better features, and broader access.

Let’s look at the landscape.

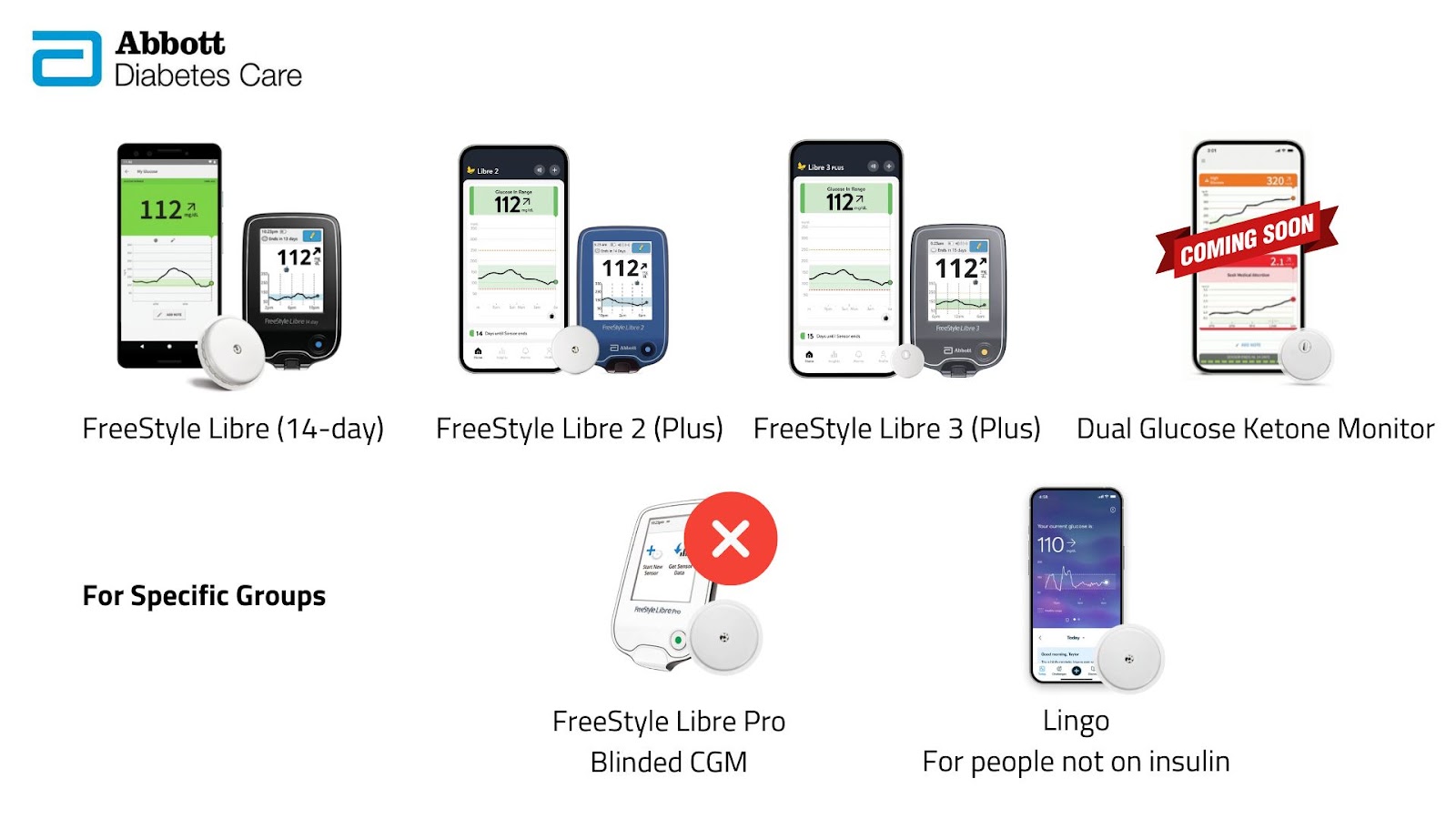

Abbott

The FreeStyle Libre family is evolving rapidly.

- FreeStyle Libre 2 and 3 are slowly being replaced by the Libre 2 Plus and Libre 3 Plus, removing the need to scan the sensor.

- The long-awaited Dual Glucose Ketone sensor will measure both glucose and ketones — pending CE and FDA approval.

- The Libre Pro blinded version has been discontinued.

- Abbott’s Lingo line targets wellness users in the UK and US, though earlier promises of ketone and lactate tracking and a separate Lingo Rio sensor have gone quiet.

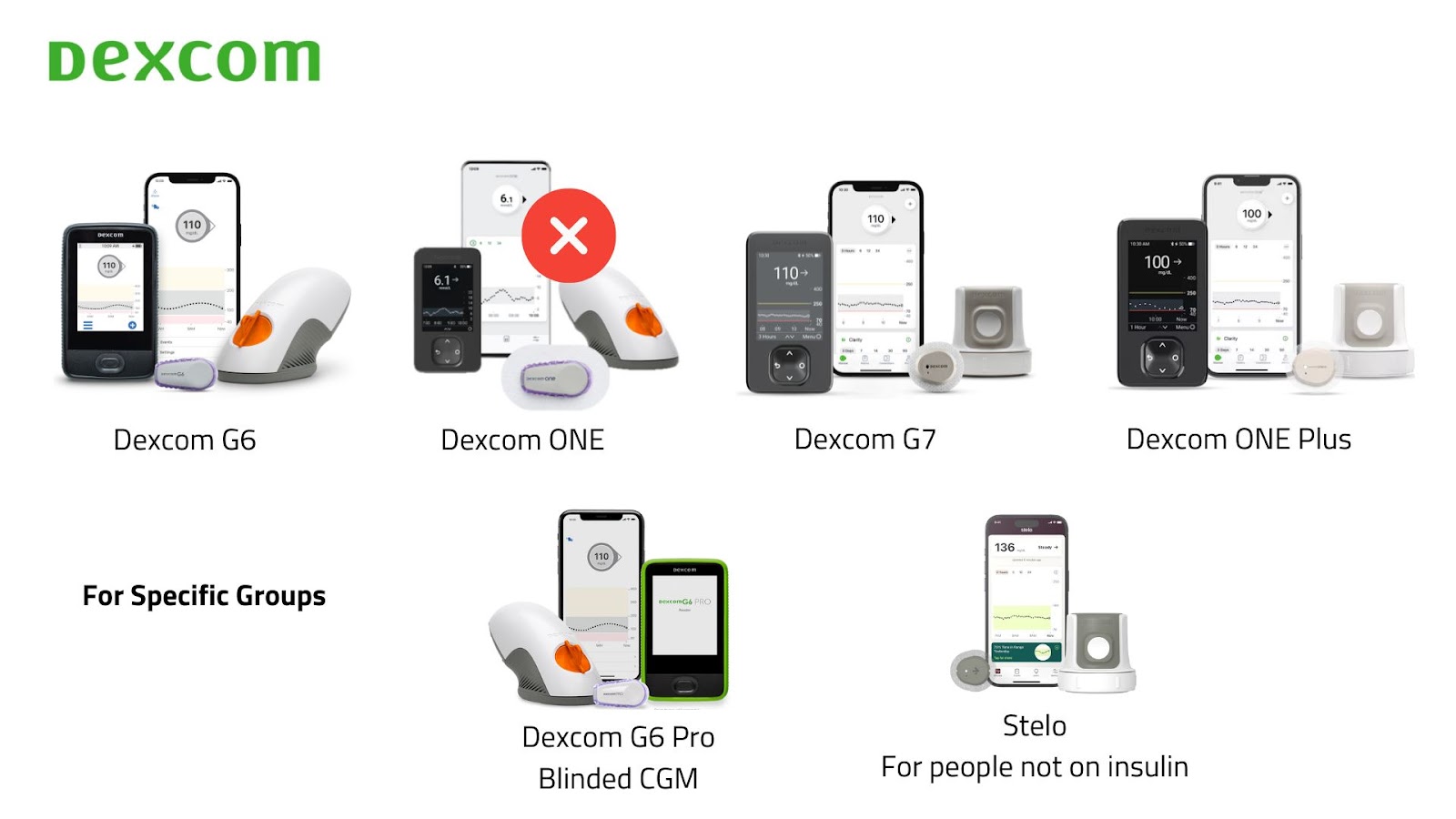

Dexcom

- Dexcom G7 is approved to last up to 15 days in the US (other regions to follow), and its app includes AI-based meal recognition and insights.

- Dexcom ONE is being phased out, and Dexcom ONE+ is expected to follow the 15-day path.

- The Stelo sensor for people not on insulin launched in the U.S.

Medtronic (MiniMed)

- Guardian 3 is slowly being replaced by Guardian 4.

- Simplera, an all-in-one disposable CGM, launched in Europe, with a U.S. rollout expected late 2025. Future versions of Simplera may extend to 10 or 14 days.

- The new Instinct sensor, designed for the MiniMed 780G closed loop, is now live in the U.S.

Disclaimer: The Instinct sensor is not yet available outside the U.S., and no launch date has been announced. Use requires an upgrade of the MiniMed 780G to software version 6.42 or higher.

The Rising East

Image > World Economic Forum news release June 23, 2025

The center of innovation is shifting eastward.

Asian manufacturers are reshaping the CGM landscape with rapid iteration and low-cost models.

Sinocare

Sinocare is China’s largest glucose strip producer.

- In Europe, their iCan i3 will be sold as the GlucoMen iCan (Menarini).

- Their upcoming iCan i6 offers a smaller, lighter sensor and will integrate with AI assistants like ChatGPT.

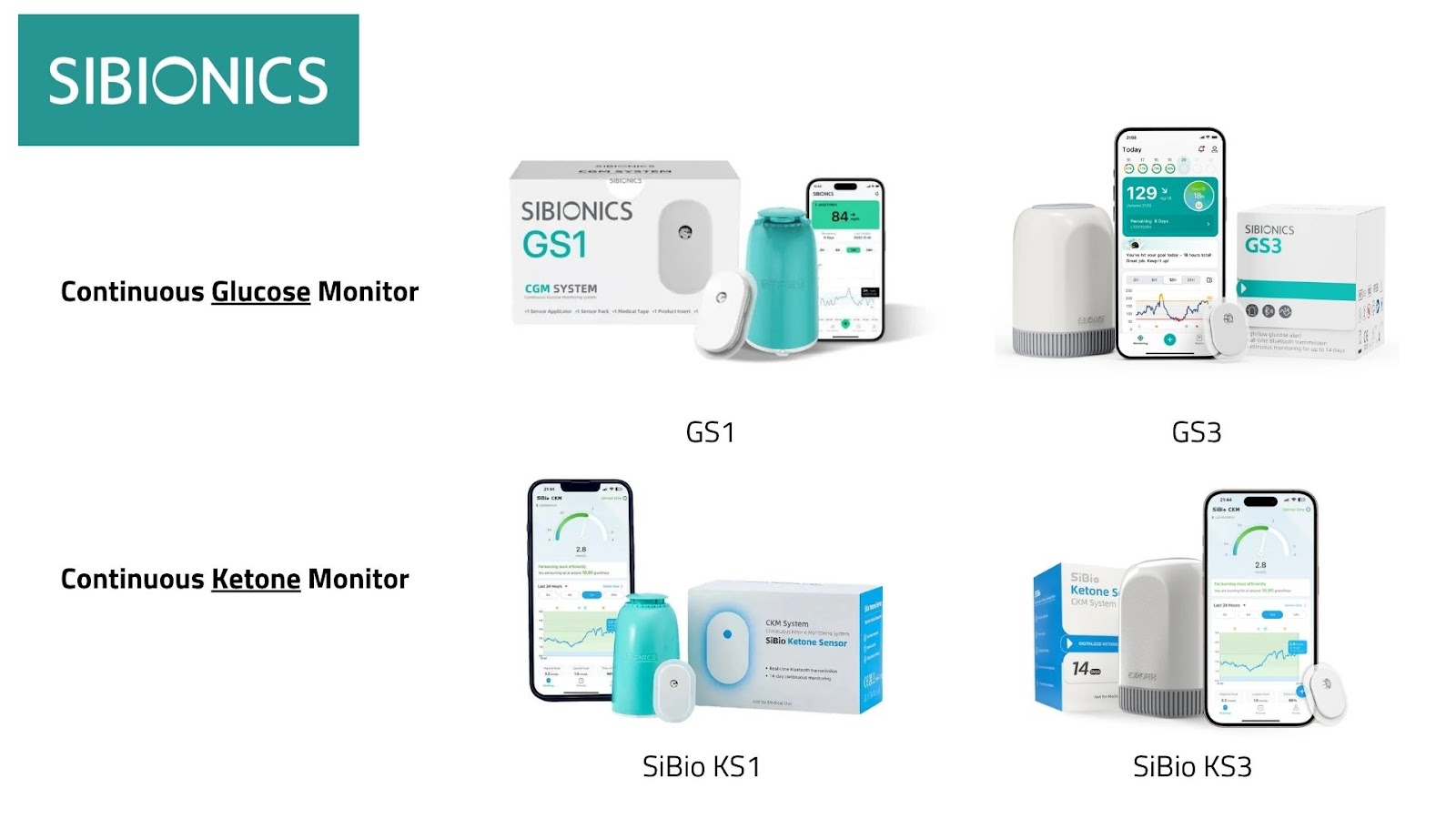

Sibionics

- The GS1 and GS3 sensors are growing across Asia and Europe (although the GS1 cannot be distributed in Germany, France, the Netherlands and Ireland because of an ongoing legal dispute with Abbott), with CE approval for the smaller GS3.

- Also available: a continuous ketone monitor and SiBio watch with direct sensor-to-watch link.

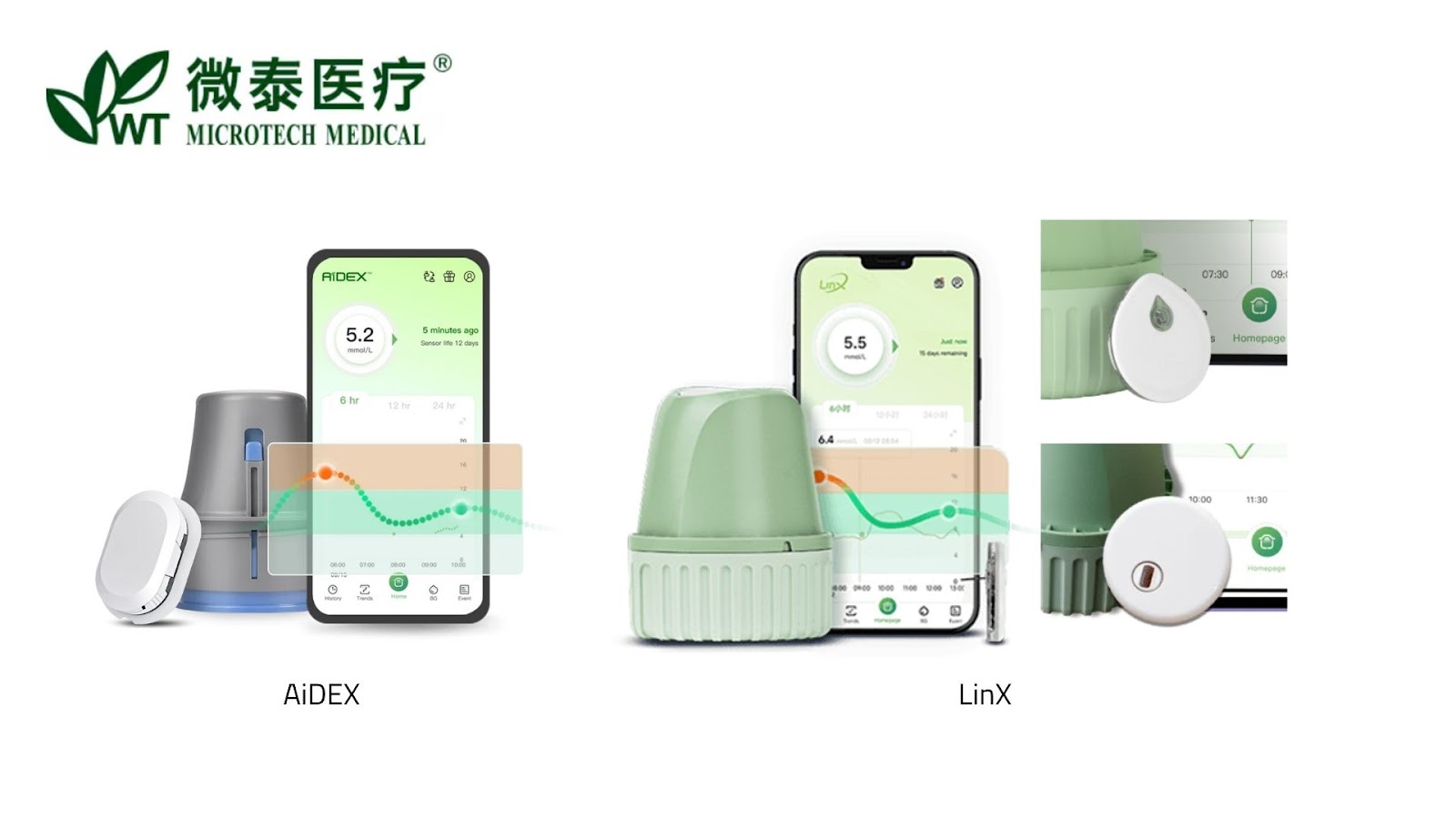

MicroTech Medical

Transitioning from AiDEX to LinX, an all-in-one version.

Different distributors offer different form versions of the sensor, eg Mediq, BUZUD, Intuitive Therapeutics, Dolly Pharma etc

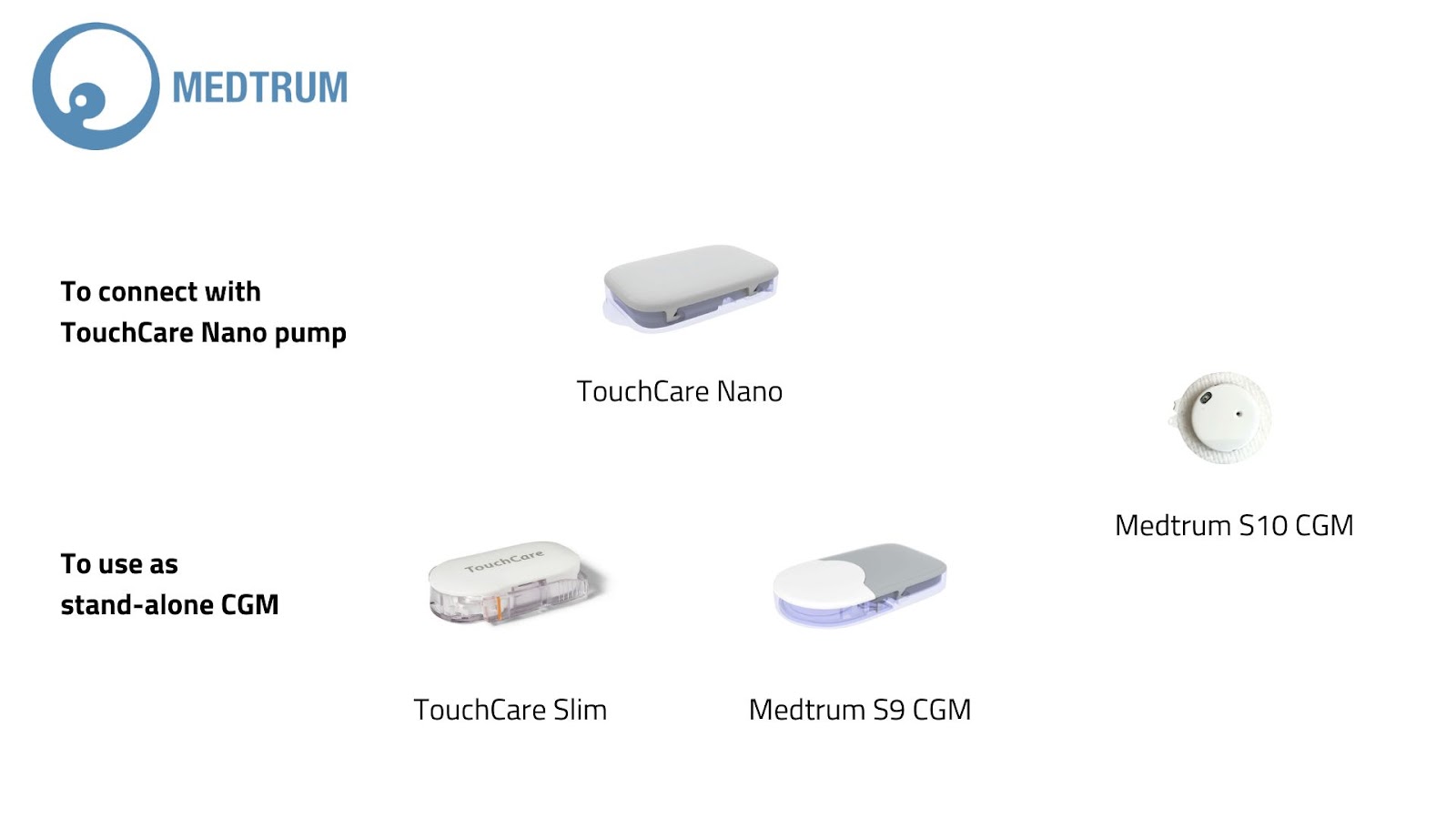

Medtrum

The TouchCare Slim 14-day sensor is being replaced by the Medtrum S9, soon evolving into the S10 — the smallest CGM on the market.

Medtrum also runs a closed-loop system combining its TouchCare Nano pump and TouchCare Nano CGM.

Yuwell

The AI-driven Anytime 5 series extends weartime to 16 days and shortens warm-up to 45 minutes.

Ottai Medical

Operating mainly in China, now expanding into niche UK markets.

Bionime

Taiwan’s iFree CGM launched domestically in 2023; global rollout is coming (CE-label is pending).

i-Sens

- The CareSens Air series now works without calibration. It is distributed widely across Europe, Asia, and Oceania.

- An upgraded 18-day version and 70% smaller design is in development.

Syai Health

The new Syai Tag CGM weighs just 1.2 g and includes an LLM-powered app linked to ChatGPT, soon transitioning to its own AI model.

Hippo Medical

Their CE-MDR–certified Hippo CGM is expanding across Europe, Latin America, and Asia.

Glunovo

Glunovo’s older models Infinovo P3 and i3 are fading.

Meiqi

Meiqi Medical keeps focusing on hospital-based systems in China.

Join our free courses on CGMs, pumps, and AID systems

The European Comeback

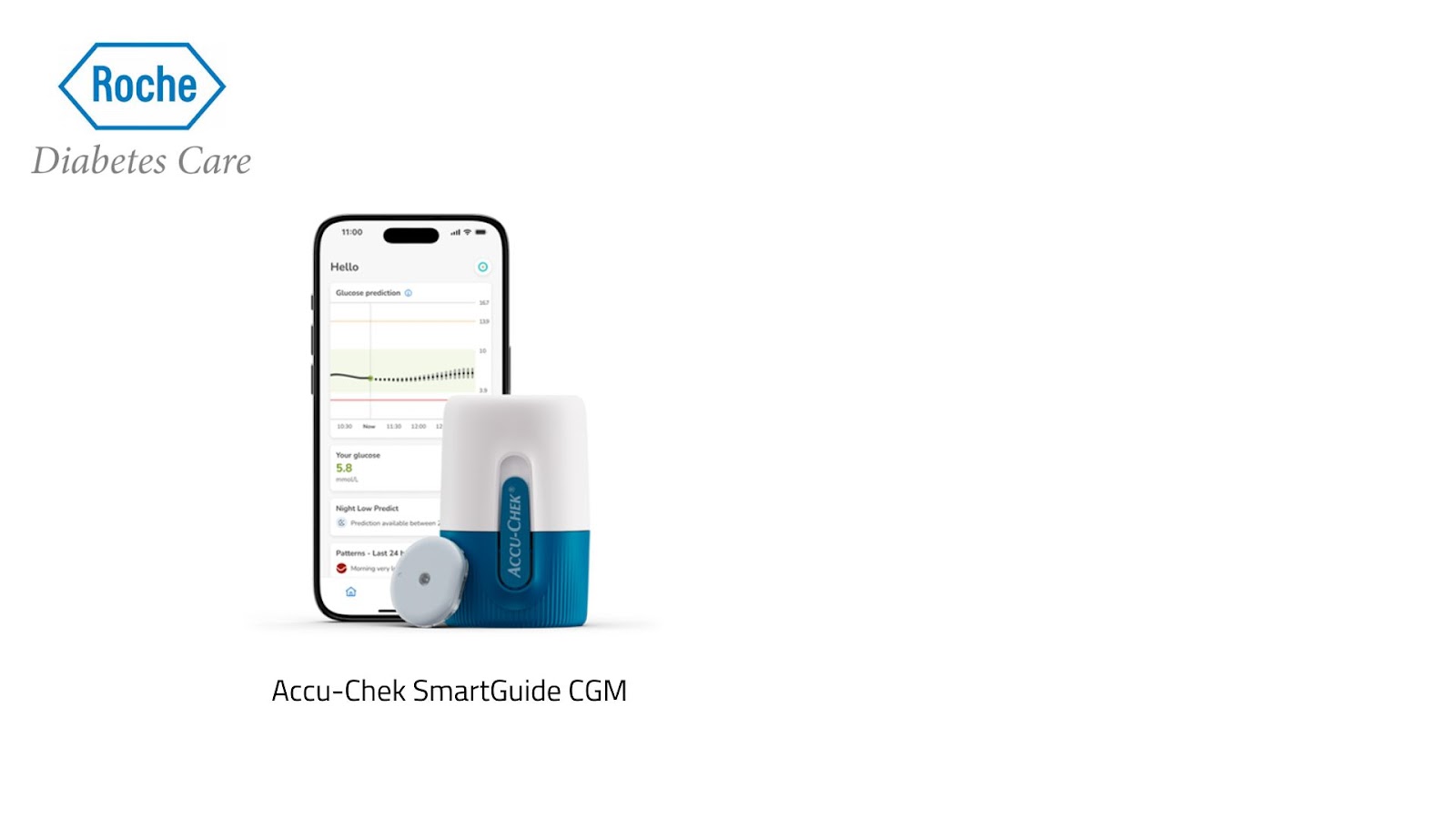

After years of dominance from abroad, Roche reenters the scene with the Accu-Chek SmartGuide CGM solution — Europe’s first major new player.

It features AI-enabled predictive alerts to help users act before it happens, and integration with the mySugr app has begun for smoother real-time management.

The Implantables

Sensionics continues with the Eversense 365 — the only implantable CGM available today.

- The upcoming Gemini and Freedom sensors will eliminate the external transmitter altogether.

Meanwhile, Indigo, Lifecare, and GlucoTrack are

- testing longer-term implantables — up to three years in the body —

- some even measuring ketones, lactate, and alcohol,

- or measuring glucose directly in blood.

Accuracy Still Matters

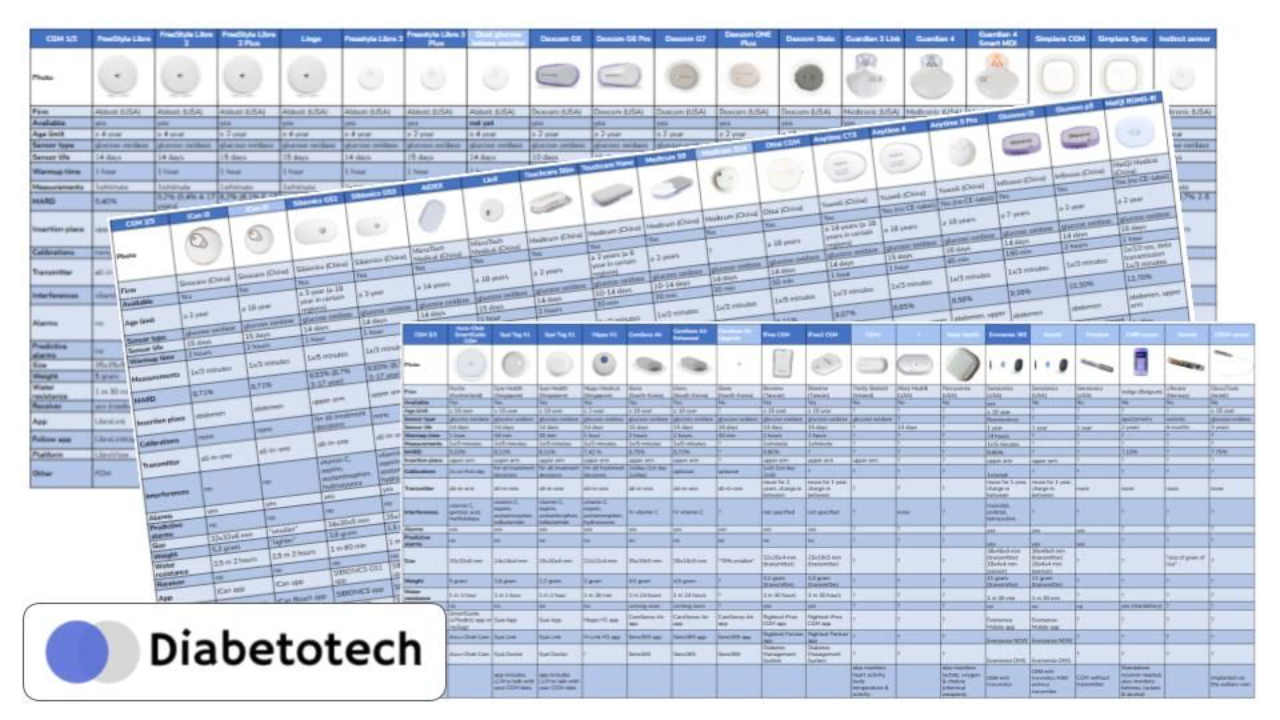

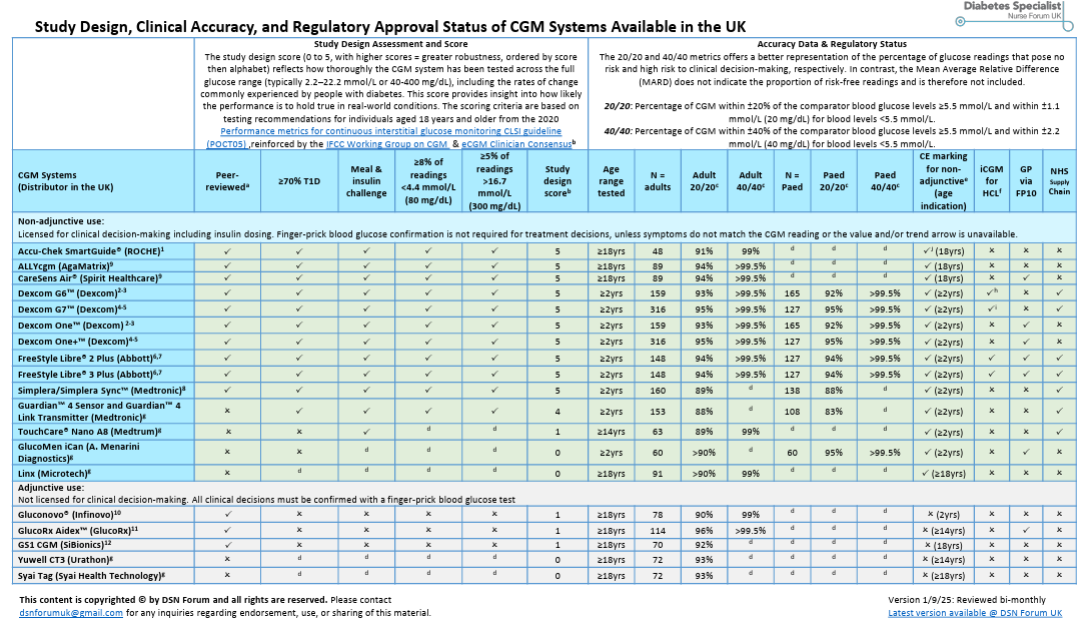

Image > DTN-UK’s CGM Accuracy Comparison Chart

Most CGMs report a MARD <10%, but that doesn’t tell the whole story.

Methodologies differ: capillary vs. venous sampling, adult vs. pediatric cohorts, steady vs. rapid glucose change.

Even vitamin C, paracetamol, or hydroxyurea can distort readings.

For those dosing insulin — especially in closed-loop systems — this matters.

Insulin is powerful, and errors can be fatal.

That’s why unified international accuracy standards are urgently needed.

Until then, clinicians must stay vigilant, read device labels carefully, and teach patients context.

The Other Kind of Risk

Privacy is the new frontier.

Health data from wearables can be shared, sold, or analyzed beyond clinical care.

Regulation often lags behind innovation.

Users deserve transparency: who sees their data, and for what purpose?

Emotional risk is another.

For people using CGMs for wellness, not therapy, constant feedback can create anxiety over normal fluctuations.

Glucose isn’t a moral score.

It’s biology — complex, adaptive, and human.

The Bright Horizon

Still, optimism wins.

More devices mean more access.

More access means more insight.

And more insight means a deeper understanding of how our bodies work — in real time.

Fifteen-day wear is becoming the norm.

AI-assisted guidance is improving education.

Interoperability between CGMs, pumps, and digital twins is on the horizon.

The direction is right.

The wave is strong.

We just need to ride it with wisdom.

Big Ideas

- Growth creates new challenges. Complexity is a sign of progress.

- Cheap doesn’t mean inferior. It means more people included.

- Accuracy remains sacred. Especially when insulin is involved.

- Privacy is health. Guard your data as you guard your pancreas.

- Perfection isn’t the goal. Awareness is.

For Clinicians and Educators

- Stay updated on emerging CGMs. You’ll soon encounter many in the clinic.

- Focus on trend interpretation rather than single-point readings.

- Teach patients that data is information, not identity.

- Verify accuracy and interference profiles before integrating with pumps.

- Keep conversations open about anxiety, privacy, and realism.

The future of CGM is not about replacing intuition with automation.

It’s about amplifying awareness — turning invisible biology into visible wisdom.

So let’s welcome this wave.

Let’s shape it.

Let’s make sure technology serves humanity — not the other way around.

“The art of progress is to preserve order amid change, and to preserve change amid order.” — Alfred North Whitehead

👉 Click here to explore the full CGM comparison and updates

Kind regards,

Written with ChatGPT5, but author checked wording