Diabetes Technology Update – Summer 2025

Aug 22, 2025

By now, all major diabetes technology companies have shared their Q2 2025 results with investors.

Here’s a round-up of the most relevant developments for people with diabetes and their healthcare teams.

As a reminder, there are currently eight commercially available closed-loop systems.

Let’s review each, so you’re fully up to date following our May 2025 blog.

Get Access To Updated Diabetes Technology Courses

Medtronic > MiniMed

Q2 Report

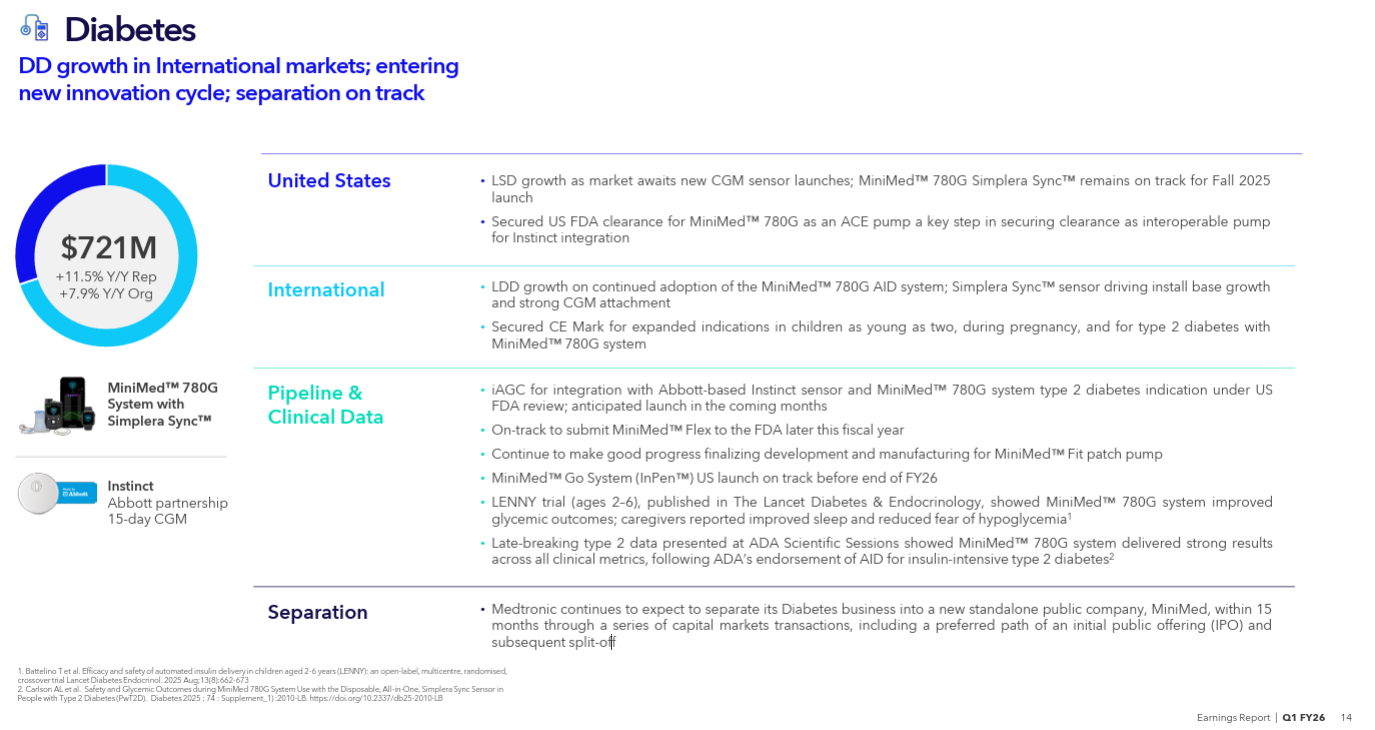

Medtronic’s Diabetes Unit (MiniMed) will spin off from Medtronic within 15 months. Shares will only be available after the spin-off and listing.

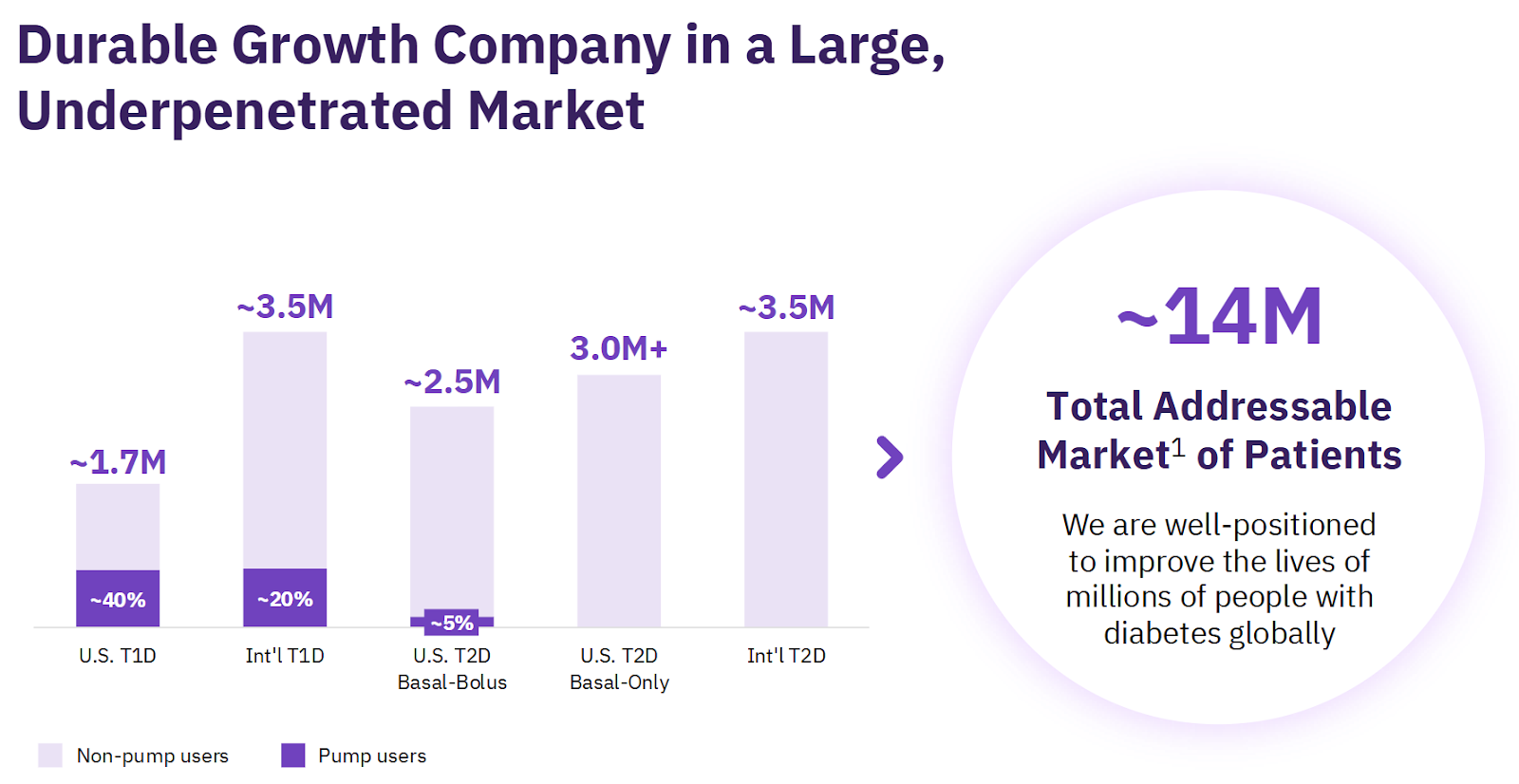

With revenues of $2.8 billion in 2025, MiniMed is the third-largest diabetes tech company globally, behind Abbott and Dexcom.

MiniMed currently offers

- the MiniMed 780G system – the most widely used closed-loop system worldwide, often recognised for having the best algorithm.

- and the Smart MDI System (MiniMed Go System) – integrates InPen with the Simplera (or Guardian) CGM.

Highlights from ADA2025

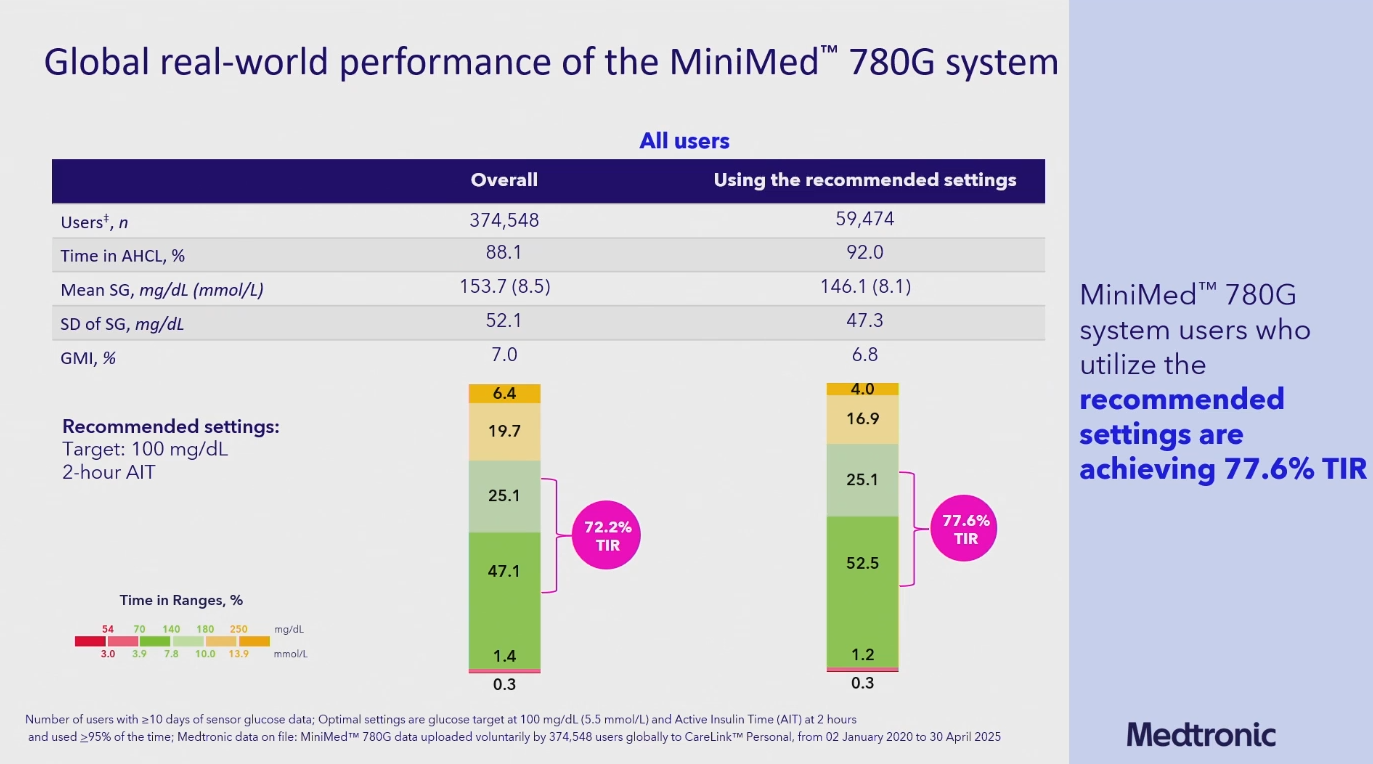

At ADA2025, Medtronic shared the largest real-world dataset ever presented on a closed-loop system (here the Minimed 780G), based on access of CareLink global on April 3, 2025:

- Overall group (n=374 548): TIR (Time In Range) 72%, TBR 1.7%, with a TITR (Time In Tight Range = 70-140 mg/dL or 3.9-7.8 mmol/L) of 47%

- Group using the recommended settings (n=59 474): TIR 78%, TBR 1.5%, TITR 53%

Note: recommended settings are active insulin time of 2 hours, and a glucose target of 100 mg/dL (5.5 mmol/L)

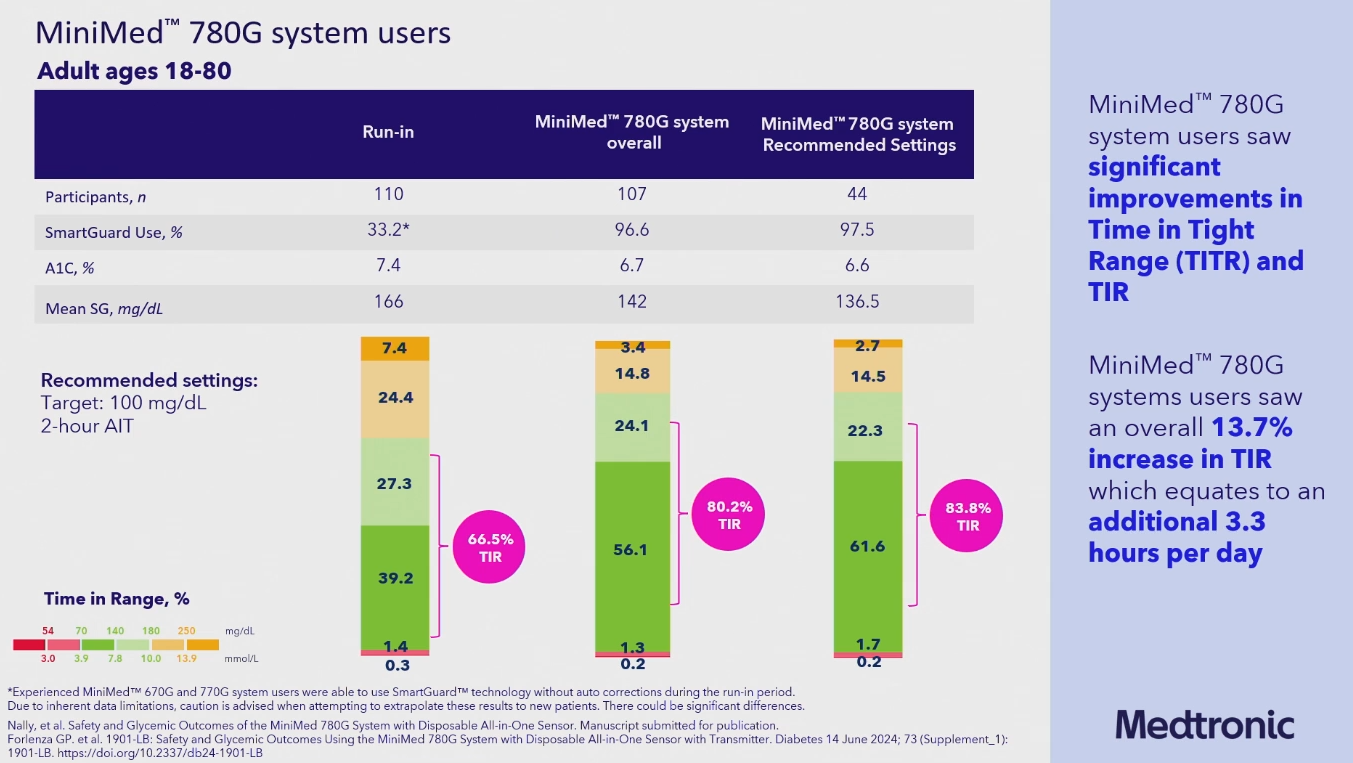

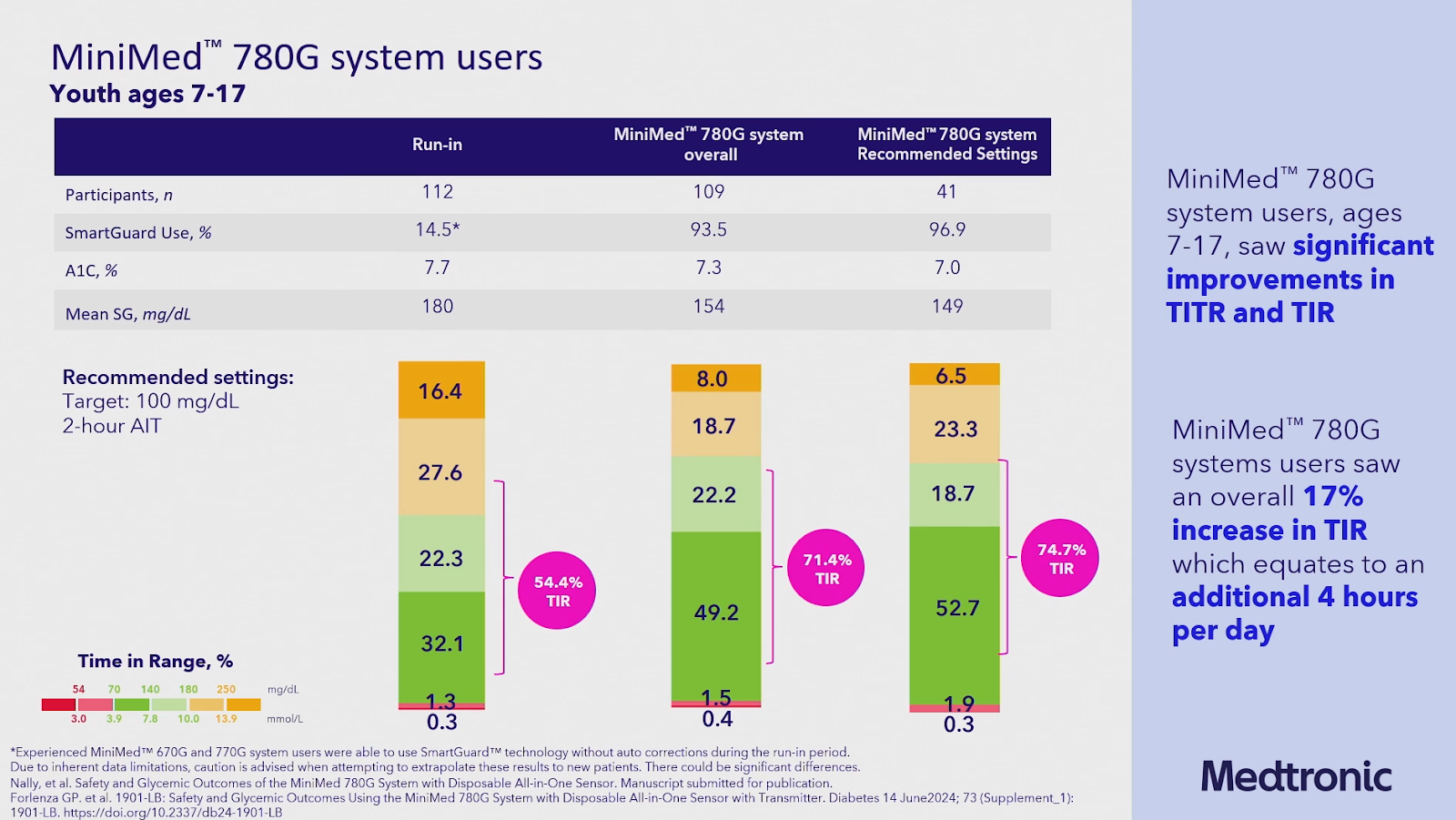

They also reminded us of the great results of the pivotal trial (before and after study) of the MiniMed 780G study with the Simplera Sync sensor in people with type 1 diabetes (with an updated algorithm), which were presented at ADA2024 (not published yet).

- n=110 adults (18-80 years): TIR 80%, TBR 1.5%

- n= children (7-17 years): TIR 71%, TBR 1.9%

- And even better results on recommended settings!! (TIR 85% in adults and 75% in children)

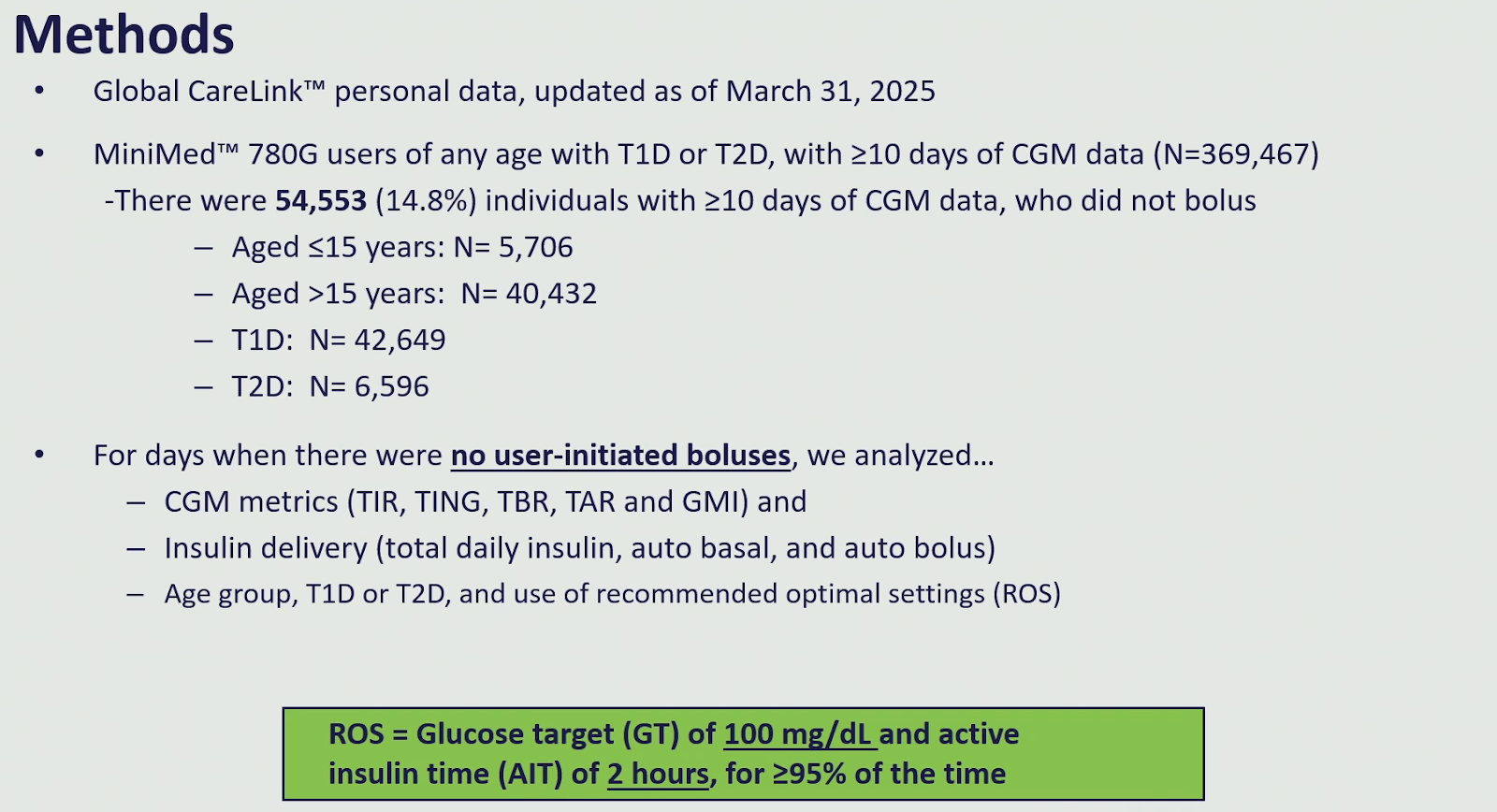

We also saw real-world data of n=54 553 users who didn’t bolus for a full day, and CGM results of the days that no user bolus was given:

- For the overall group (n=54 553): TIR 71%, TBR 0.9%

- For people using the recommended settings (n=12 723): TIR 76%, TIR 0.8%

This means that even on days that no user boluses were given, many people using the Minimed 780G on average stayed in range (TIR >70),

especially those using the recommended optimal settings!

Challenges

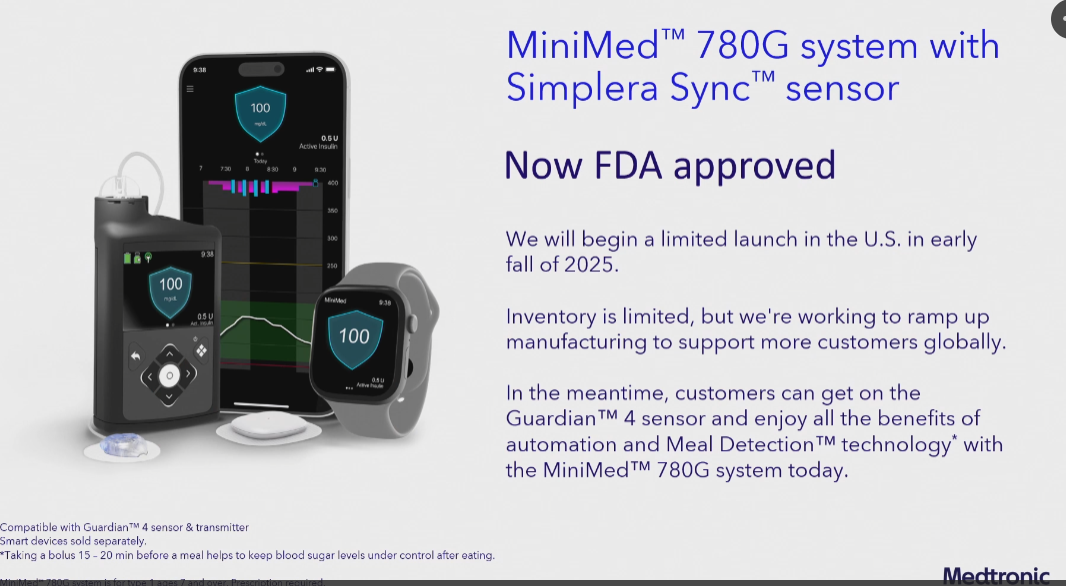

Medtronic is in the midst of switching the Guardian 4 to the Simplera Sync, but inventory of the Simplera Sync sensor is limited.

Users of the Simplera Sync sensors in Europe are experiencing short-term delays receiving their sensors as Medtronic ramps up manufacturing capacity,

and launch in the US will only start in the fall of 2025.

Coming “soon” (no timeline available)

MiniMed is actively working on a fully interoperable ecosystem where users can switch between pumps and pens in one app:

- Algorithm: SmartGuard Advance, allowing optional meal boluses.

- CGM options: Simplera or Abbott-based Instinct sensor.

- Delivery options: InPen, 800-series tubed pump (Flex), or patch pump (Fit).

Recent updates

- CE-approval for use of the Minimed 780G in children ≥ 2 years, people with type 2 diabetes, and during pregnancy.

- Launch of the Instinct CGM name.

- A recent study highlights the value of continuous ketone monitoring for detecting infusion set failures — hopefully, the Instinct CGM will integrate this capability in the future.

Insulet

Q2 Report

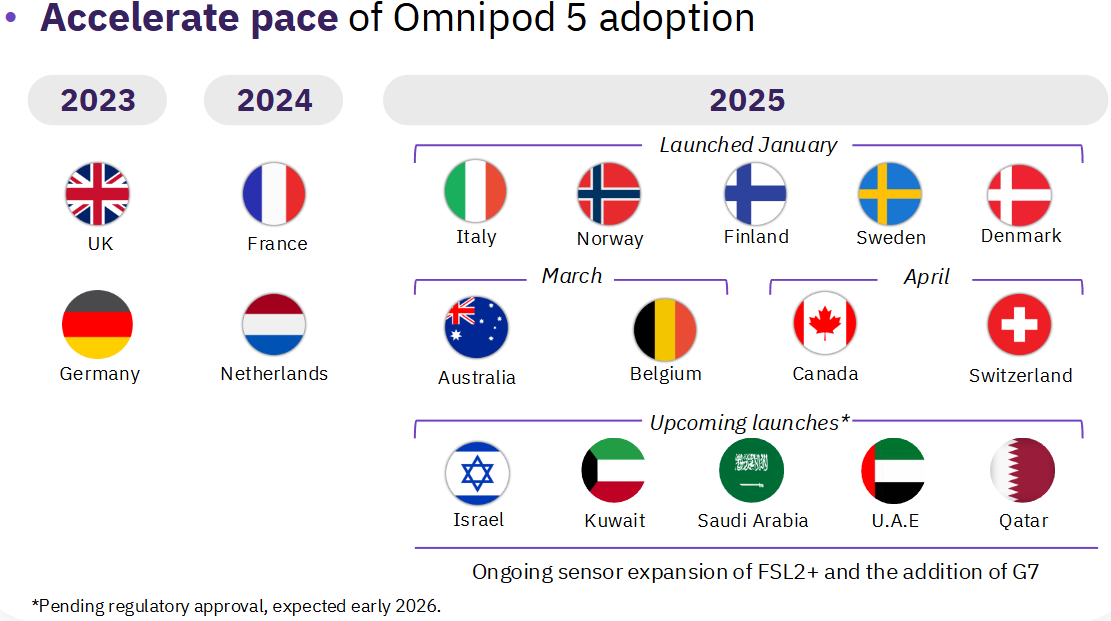

Insulet’s Omnipod 5 is the leading patch pump closed-loop system and is growing rapidly, especially in the US where it’s also approved for type 2 diabetes (including basal-only users).

Internationally, the Omnipod 5 is scheduled to launch in Israel, Kuwait, Saudi Arabia, the UAE, and Qatar.

Highlights from ADA2025

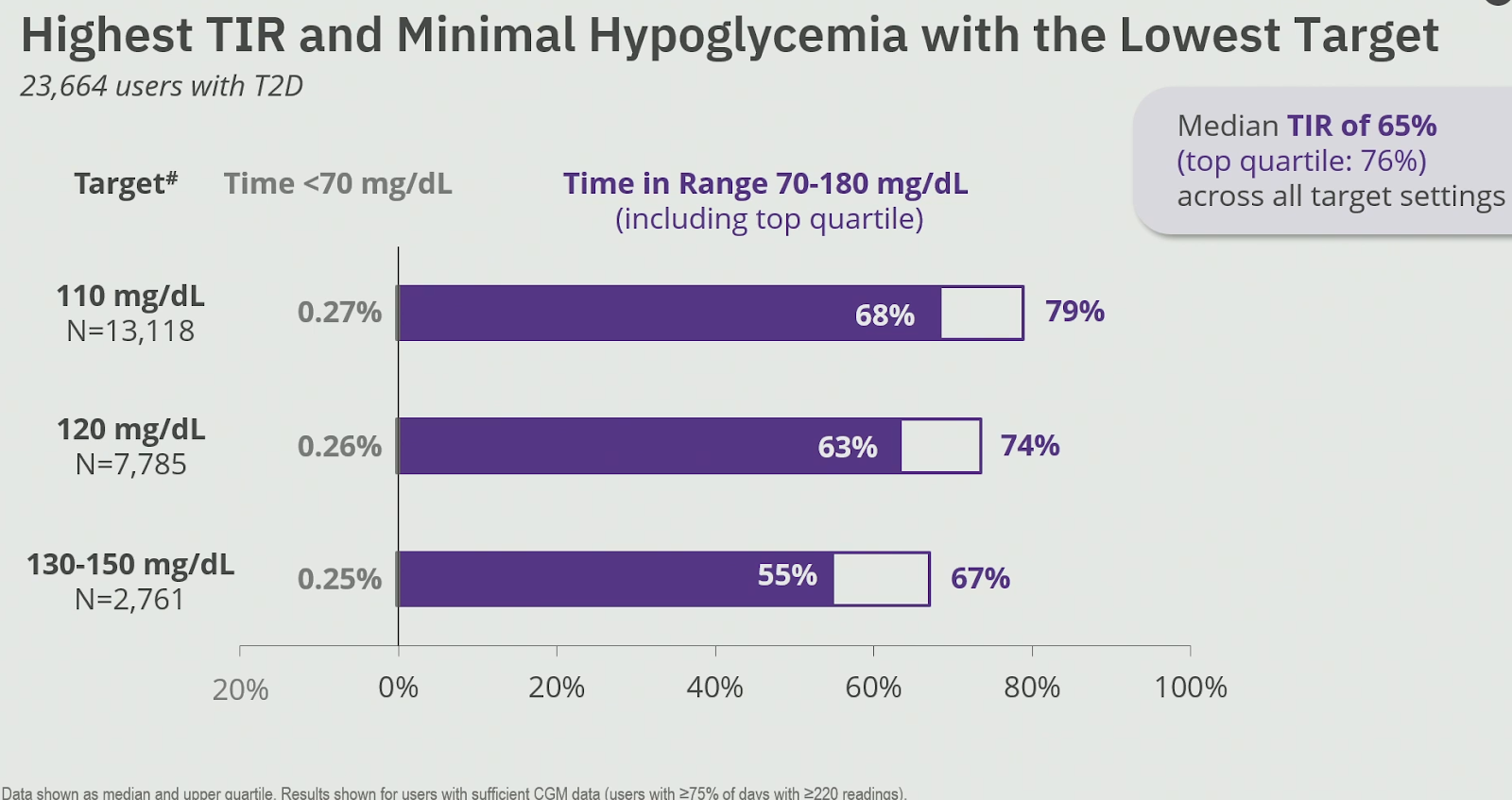

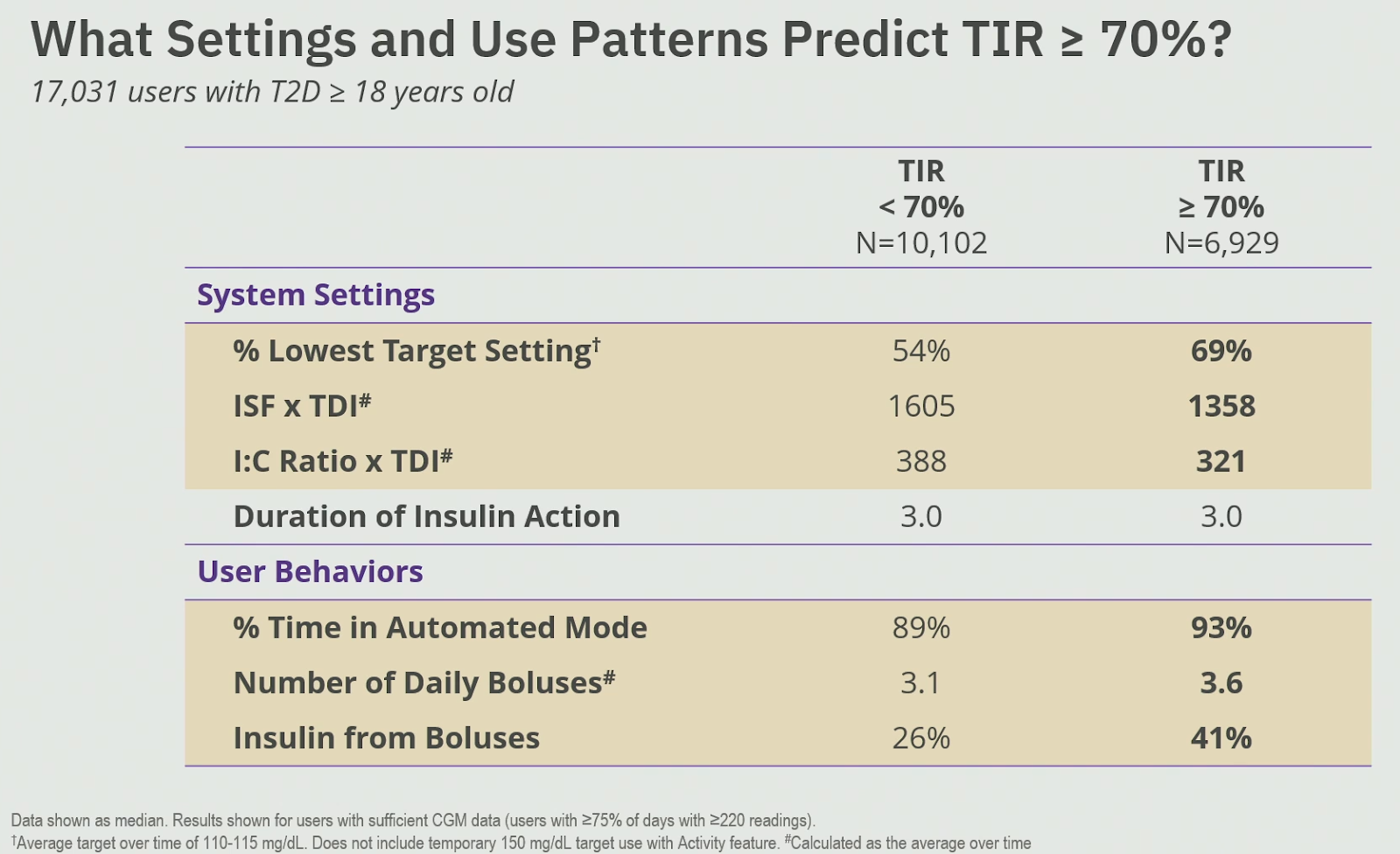

At ADA2025, Insulet reported real-world outcomes of the Omnipod 5 system in n=23 664 adults with type 2 diabetes in the United States.

The overall median Time in Range (TIR) was 65%, but outcomes varied significantly depending on the chosen glucose target:

- Glucose target of 110 mg/dl (6.1 mmol/l): TIR 68%, TBR 0.3%

- Glucose target of 120 mg/dl (6.7 mmol/l): TIR 63%, TBR 0.3%

- Glucose target of 130-150 mg/dl (7.2-8.3 mmol/l): TIR 55%, TBR 0.3%

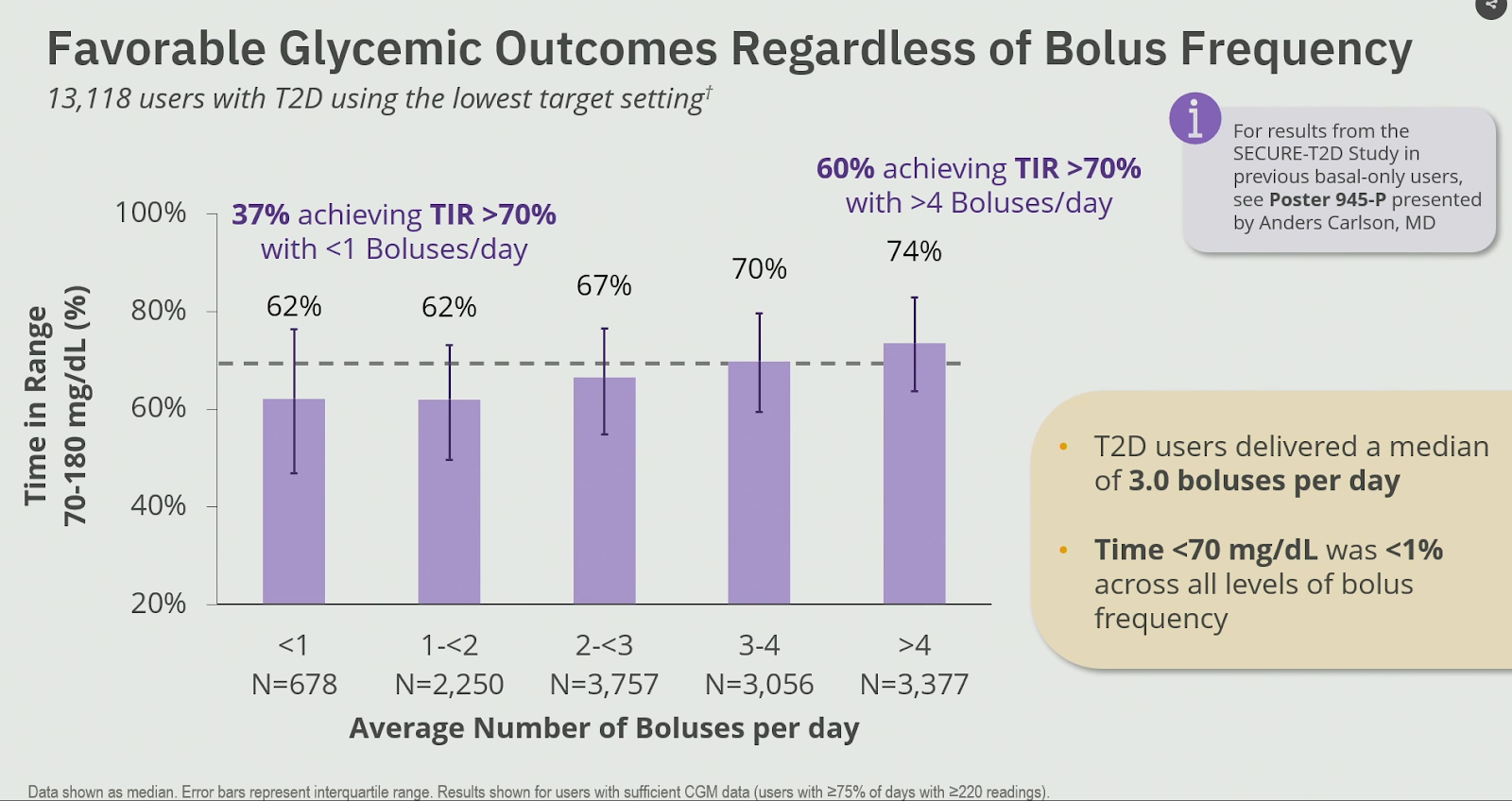

Of the n=678 people with type 2 diabetes who used the lowest glucose target and bolused <1x/day (so using the Omnipod 5 system as a basal-only system):

- the TIR was 62%, and 37% of those people achieved a TIR of >70%.

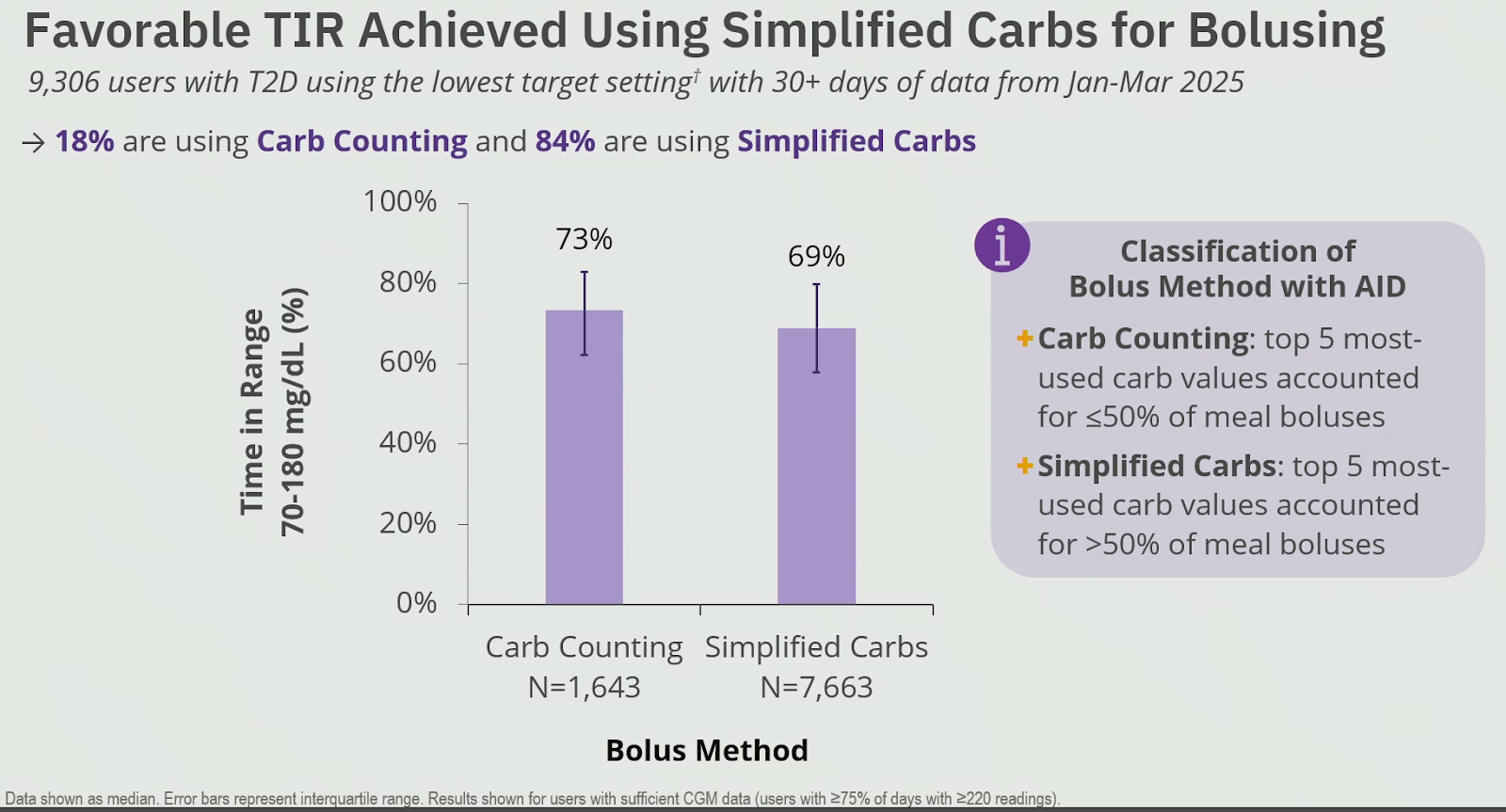

Most people with type 2 diabetes on the Omnipod 5 used simplified carb counting (preset carbs per meal type),

which only had a minor trade-off in TIR compared to exact carb counting.

Based on their data, researchers at Insulet concluded that the best TIR results were seen with

- The lowest glucose target of 110 mg/dL (6.1 mmol/L)

- An insulin sensitivity factor of ≤ 1500/TDI for mg/dL (< 83/TDI for mmol/L)

- And a carb ratio of ≤ 350/TDI

(TDI = total daily insulin dose - in units per day)

Recent updates

- Omnipod 5 + FreeStyle Libre 2 Plus now supports a “follow” function in the UK and the Netherlands via the LibreLinkUp app, once users link their Omnipod account to LibreView. John Pemberton has created an excellent step-by-step guide for this. Other regions are expected to follow.

- Although off-label, a recent study found that using U200 insulin in the Omnipod 5 system can be a viable option for people with high insulin needs, and Chu et al. provided practical guidance on how to implement it.

Tandem Diabetes Care

Q2 Report

Tandem Diabetes Care currently offers 2 Tandem pumps with Control-IQ(+) technology:

- The Tandem t:slim X2 insulin pump, which is available in 25 countries

- And the Tandem Mobi, currently limited to the US and compatible only with iPhone. International launch has been pushed to 2026.

Highlights from ADA2025

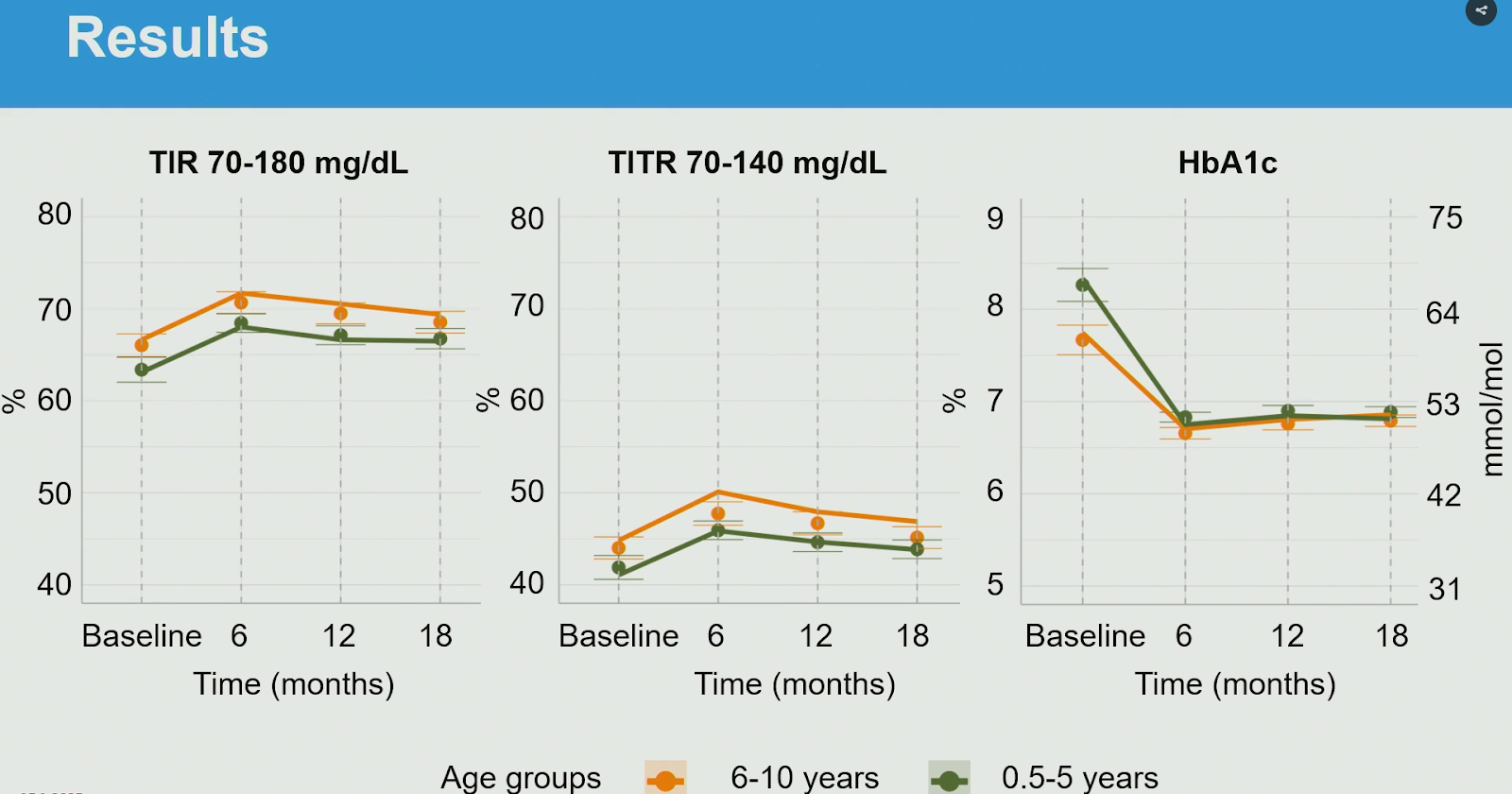

At ADA2025, a prospective study in children with type 1 diabetes from 30 diabetes centers in Italy using Tandem Control-IQ

showed that the system was safe and effective, also for children <6 years old:

- n=131 children <6 years old: TIR 61% > 68%, TBR stable at 2% (1 DKA episode was reported between 12 & 18 months)

- n=160 children 6-10 years old: TIR 66% > 69%, TBR stable at 2% (1 severe hypoglycemia episode was reported between 12 & 18 months)

Pipeline

- FreeStyle Libre 3 Plus integration launched June 2025 for t:slim X2 (full US rollout this fall; international after). Mobi integration is expected late 2025.

- Android compatibility for the Mobi pump is expected by the end of 2025.

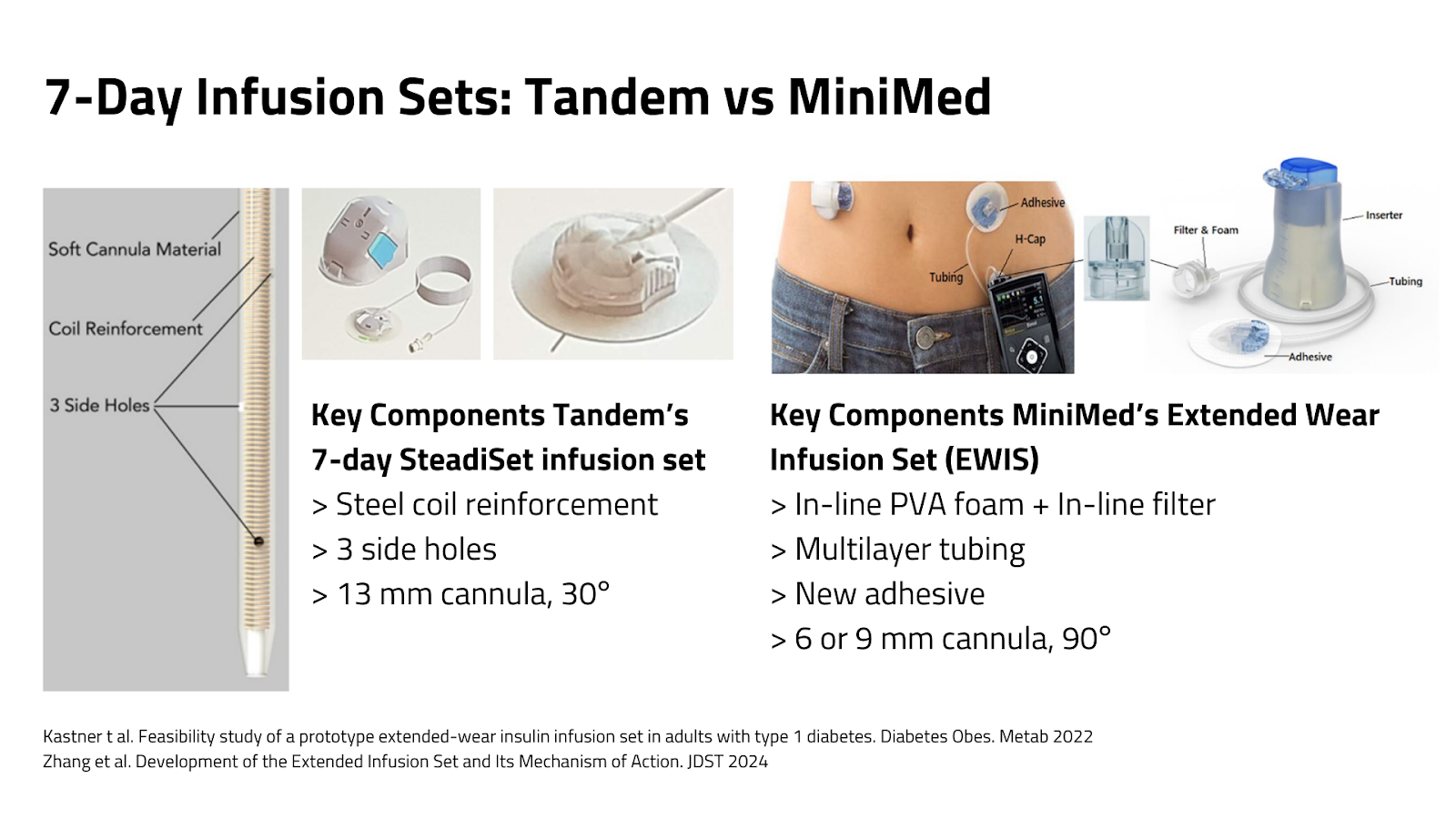

- The 7-day Steadiset infusion set and the Mobi Tubeless pump (with built-in 7-day Steadiset) are expected in 2026 (in the US).

- A recent study showed that 95% of the 7-day Steadiset infusion sets lasted for 7 days (versus 78% for MiniMed’s Extended Wear Infusion Set in a previous study)

- Although off-label, a recent study found that using U200 insulin in the Tandem t:slim X2 pump can be a viable option for people with high insulin needs, and Chu et al. provided practical guidance on how to implement it.

Ypsomed > mylife Diabetes Care

On August 4th, Ypsomed sold its Diabetes Unit to TecMed AG, owned by Willy Michel (the father of Simon Michel, the CEO of Ypsomed).

TecMed AG is not listed on the stock market and does not give quarterly investor updates.

Current product

- mylife Loop powered by mylife CamAPS FX, compatible with Dexcom G6, FreeStyle Libre 3 and FreeStyle Libre 3 Plus.

- mylife CamAPS FX has demonstrated safety and efficacy across all patient groups, including pregnant women and very young children (2+ years old) with type 1 diabetes. mylife Loop, powered by mylife CamAPS FX, is the only commercial closed-loop system that allows a glucose target as low as 80 mg/dL (4.4 mmol/L).

- mylife Loop is available on Android and iOS: Following its successful pilot launch in March 2025 in Sweden, the iOS app was rolled out in most European countries, Australia and New Zealand.

Challenges

- Due to a severe shortage of NovoRapid PumpCarts; many users needed to switch to manually filled reservoirs.

- Shortage of the mylife Orbit Soft sets; most users needed to switch to the Inset or mylife Orbit Micro infusion set.

- As of August 2025, however, mylife Diabetes Care successfully managed to increase their manufacturing of infusion sets and reservoirs supporting new patient uptake.

Planned updates

- Dexcom G7 integration ongoing (no timeline available)

- Integration with Abbott’s future dual glucose-ketone sensor (no timeline available)

- Further development of the mylife Cloud therapy management platform (no timeline available)

- Patch pump in development (no timeline available)

Diabeloop

Diabeloop is a privately held company based in Grenoble, France.

It is not listed on the stock market and does not give quarterly investor updates.

Current product

- DBLG1 algorithm + Accu-Chek Insight (Roche) + Dexcom G6 was the first product launched by Diabeloop in the market. The end of life of the Accu-Chek Insight has been announced formerly by Roche, leading patients to find an alternative when the stock of infusion sets will be out.

- DBLG1 algorithm + Kaleido pump + Dexcom G6

- DBLG1 + Dana-i pump: a new partnership between SOOIL (manufacturer of the Dana pump) and Mediq was recently announced targeting a launch in Germany before the end of the summer 2025, and later in other countries after integration of the Dexcom G7.

Upcoming

- DBLG2, CE-marked since August 2025, is the Android app version of Diabeloop with improved navigation. A limited launch is planned in Germany and the Netherlands with the Kaleido pump and Dexcom G6 sensor in 2025. A full launch will be deployed early 2027 when the app is connected with Dexcom G7. Later on, the Kaleido 2 pump announced by Vicentra will be also integrated with DBLG2. DBLG2 will be also available for the Dana pump in first half of 2026.

- Integration with the Dexcom G7 and an iOS version are planned “soon”.

- DBLG2 has also been submitted to the FDA.

- Integration with a Terumo pump remains in development.

- New pumps and CGM integration are under discussion.

Beta Bionics

Q2 Report

Beta Bionics has been publicly listed since January 2025.

Current product

iLet Bionic Pancreas – works with Dexcom G6/G7 and FreeStyle Libre 3 Plus.

- Now used by >24,000 people; 25% of new starts in Q2 were people with type 2 diabetes.

Highlights from ADA2025

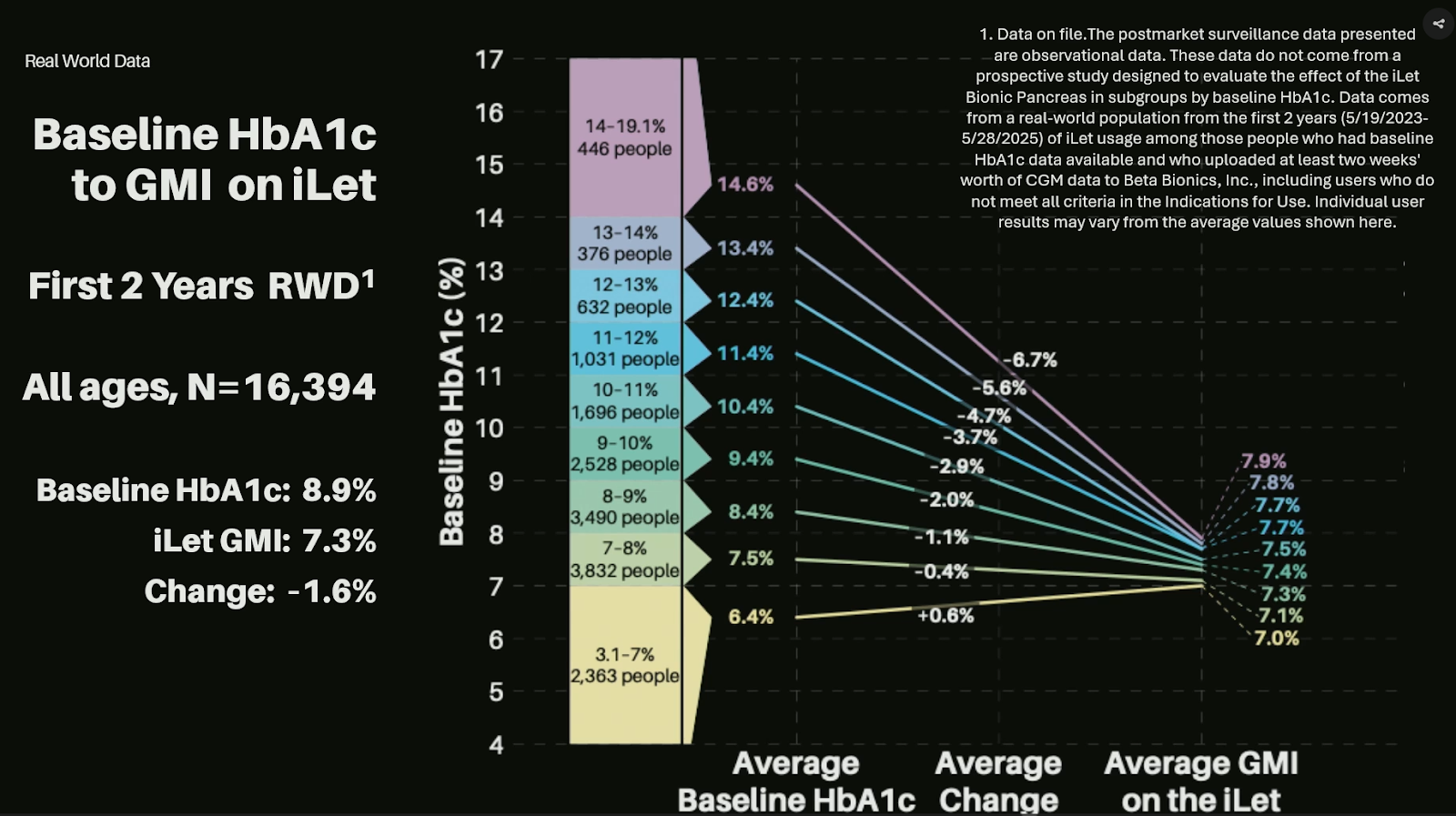

At ADA2025, 2-years real-world data of the iLet were presented.

- They included n=16 394 users who used the iLet Mobile app (n=14 369 adults, n=2 025 children)

- TIR was not reported, TBR was 1.5% on average

- HbA1c dropped from 8.9% to a GMI of 7.3% (-1.6%)

Although it looks like people with an HbA1c of < 7% do worse on the iLet, this is due to the fact that GMI overestimates values <7%.

We saw data of the actual HbA1c levels of a subset of those people, and the HbA1c did not significantly rise, even if the baseline HbA1c was <7%.

Pipeline

- Mint patch pump (Dexcom G7 & Libre 3 Plus compatible) – planned for 2027.

- iLet Duo bihormonal system – still in pre-trial phase. Beta Bionics is first conducting additional pharmacokinetic–pharmacodynamic studies using Xeris’s new pump-compatible glucagon formulation.

Medtrum

Medtrum is a privately held company based in Shanghai.

Since it is not publicly listed, the company does not release quarterly investor reports.

Current product

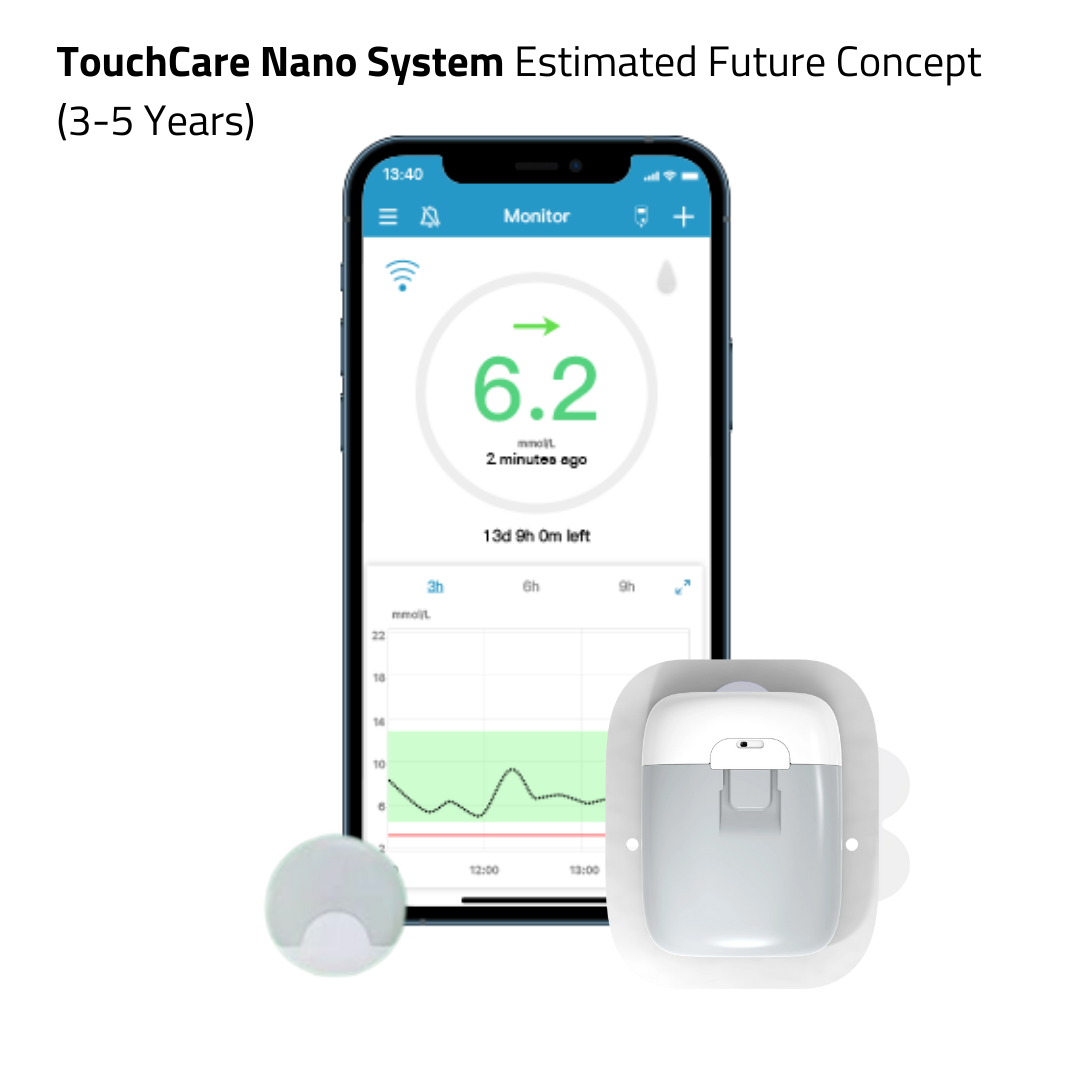

TouchCare Nano System – patch pump (200U or 300U), TouchCare Nano CGM and the APGO algorithm, available on iOS, Android or a small handset.

- The system is available in parts of Europe, New Zealand, and Latin America.

Challenges

- Legal proceedings, particularly with Insulet, prompted Medtrum to shift from the A6 and A7+ TouchCare devices to the current-generation Nano A8 series.

- Unlike other closed-loop systems, very limited data exists on the efficacy and safety of Medtrum’s CGM and closed-loop system.

- Details about the algorithm remain scarce, other than its heavy reliance on AI; the EU’s new AI Act may require greater disclosure.

Planned

- Accuracy trials of the TouchCare Nano CGM are ongoing.

- TouchCare Nano Pro CGM integration (see image, timeline not yet announced).

- Integration of a 400U TouchCare Nano Pump (timeline not announced).

Sequel Med Tech

Sequel Med tech is a privately owned company founded in 2023 in the US.

It’s not listed on any stock exchange. It’s a growing company, now employing a few hundred people.

Current product

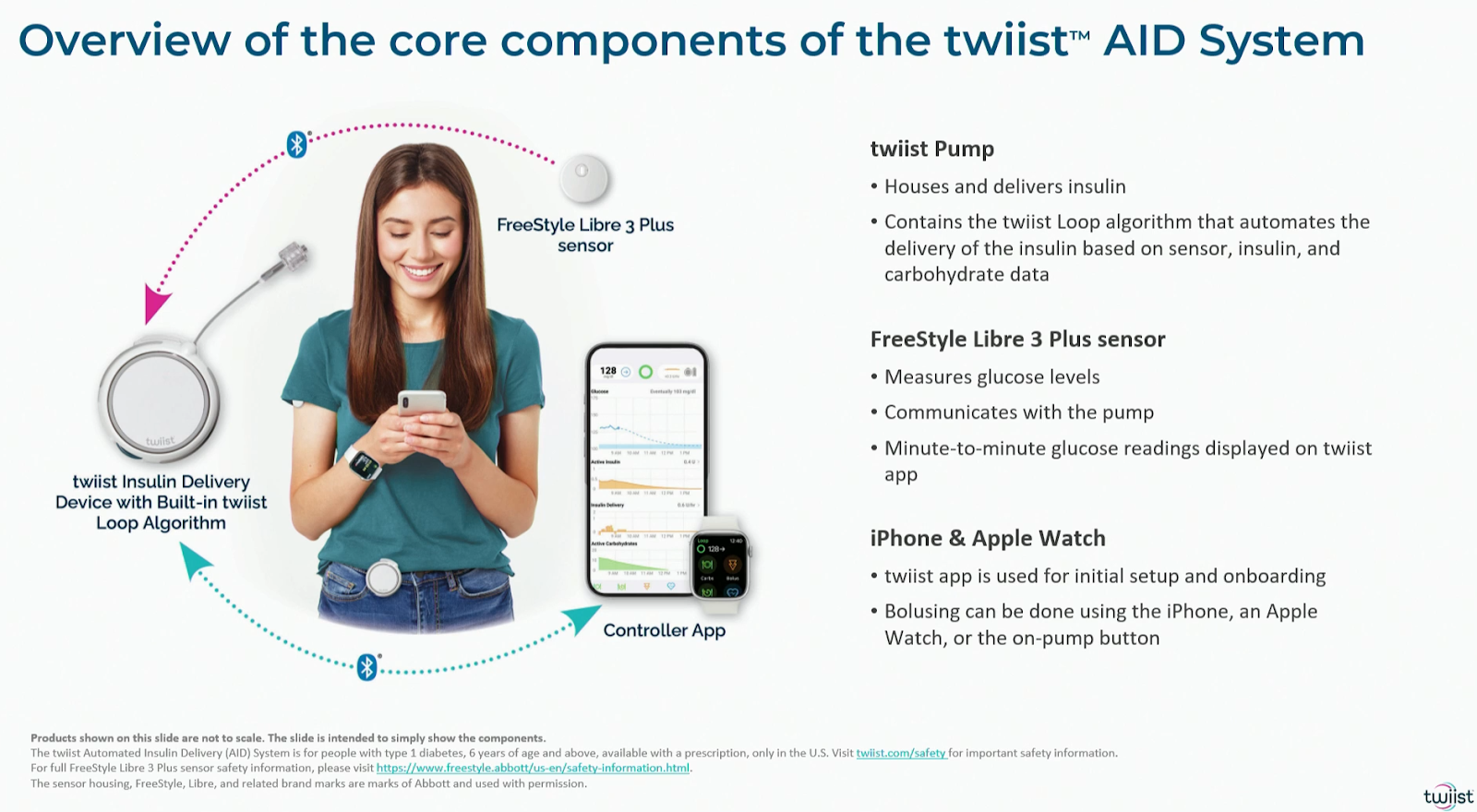

- twiist AID system – Combines the Tidepool Loop algorithm (“twiist Loop”) with the twiist tubed pump and FreeStyle Libre 3 Plus sensor. It can be controlled by an iPhone and Apple Watch. First users started July 2025 in the US, roughly 4000 people are on the waitlist.

- twiist features iiSure technology, which can detect disrupted insulin flow up to 9x faster than other pumps.

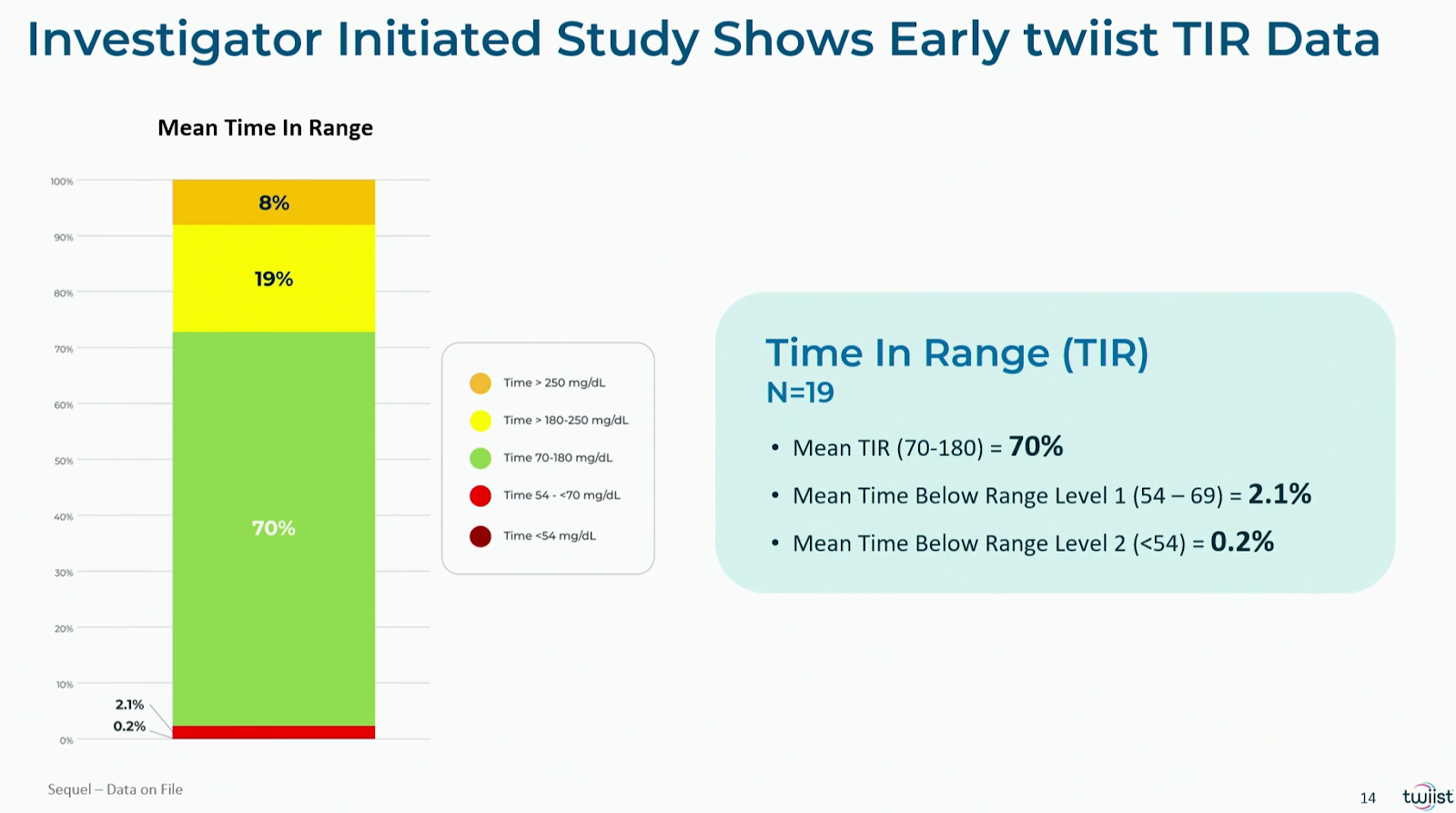

Highlights from ADA2025

At ADA2025, we saw the first preliminary real-world results of users of the twiist system:

- n=19 adults with type 1 diabetes (results after 8 weeks): TIR 70%, TBR 2.9%

- n=36 adults with type 1 diabetes (employees of Sequel Med Tech, results after 35 days): TIR 80%, TBR 3.0%

Upcoming

- Eversense 365 integration in late 2025.

- International rollout (timeline not disclosed).

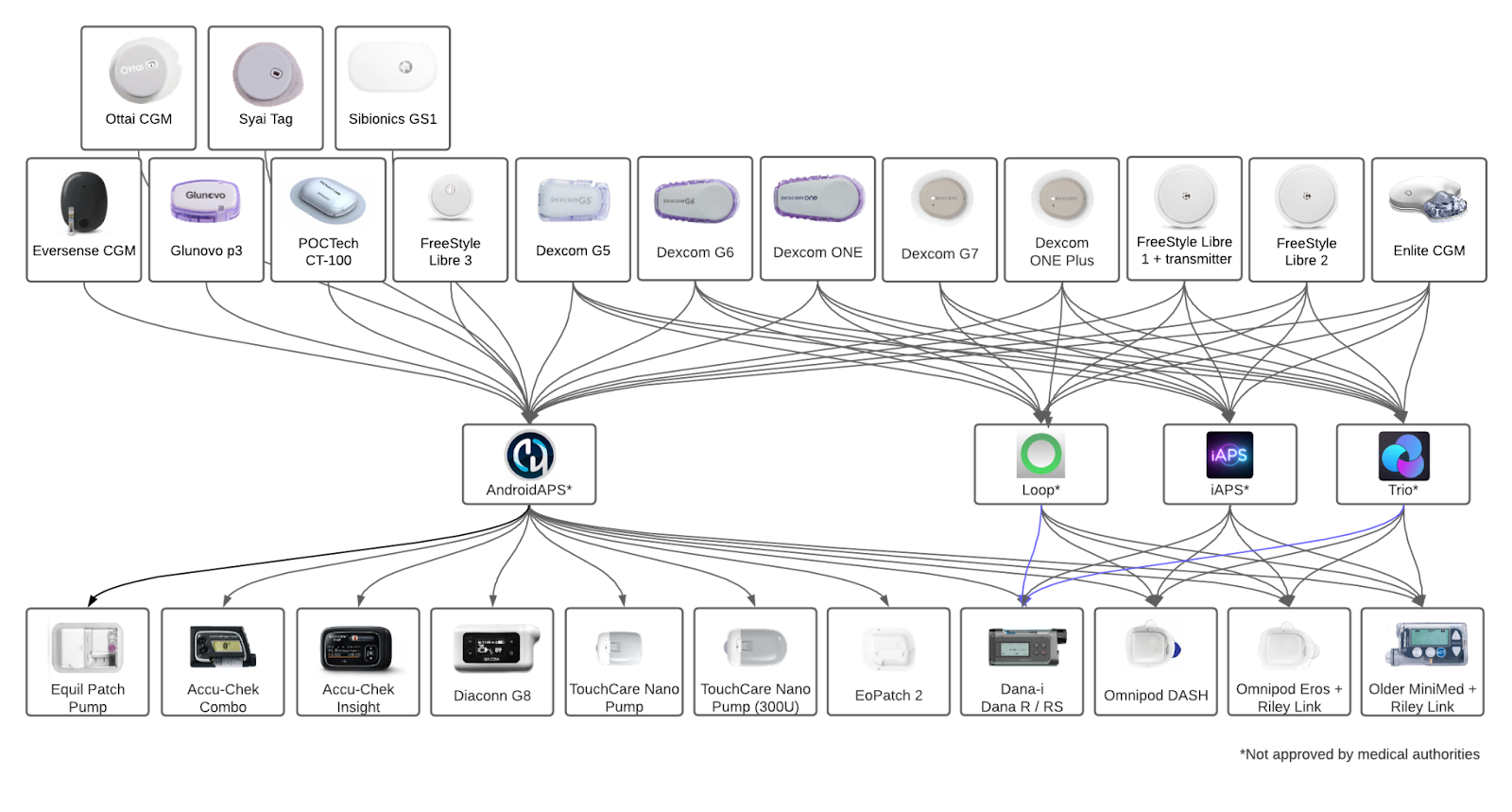

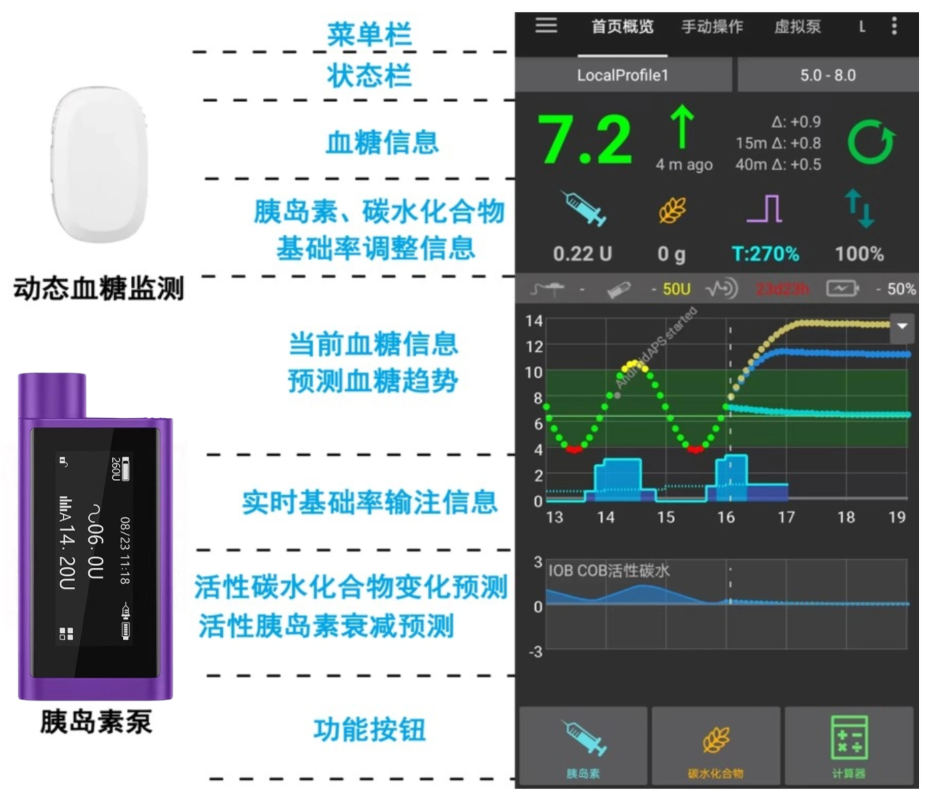

Open-source closed-loop systems

No major software updates compared to our last blog update.

Updates from China

- A recent real-world study described results of AndroidAPS in n=142 people with type 1 diabetes (age 11-35 years old) from 29 regions in China. AndroidAPS was used with CGM devices including Sibionics and AiDEX G7, and insulin pumps including DanaR, DanaRS and Equil. Average results: TIR 79%, TBR 4%.

- Most users installed AndroidAPS using the open-source code. However, a structured support module was provided by the TangTangQuan community to support safety and effective system use. (TangTangQuan is a Chinese mobile app that provides the largest online research and support community for people with type 1 diabetes in China. It runs an online platform supported by Nightscout.)

- On the TangTangQuan news channel, they also heavily promote the use of the domestic brand Kailian pumps (“Yue pump” from LenoMed, distributed by Embecta) in combination with AndroidAPS, although this pump type is not mentioned as a compatible pump on the AndroidAPS documentation.

- Based on recent publications and ongoing trials, open-source systems seem to be popular in China, although we don’t have a trusted source to confirm this.

- A recent trial in n=32 adults with type 1 diabetes showed that even with fixed meal boluses, a TIR of 80% was achieved with AndroidAPS.

Italian position statement on the use of open-source closed-loop systems

- The Italian Diabetes Societies released a position statement on the use of open-source closed-loop systems, largely aligning with the 2023 international position statement.

- In February 2024, the same working group conducted an anonymous, voluntary survey among open-source closed-loop users with type 1 diabetes — 166 from Italy and 174 from other countries — to explore their experiences and motivations. The findings highlight the key reasons participants: (A) began using an open-source system, and (B) continued using one despite the availability of commercial options.

Conclusion

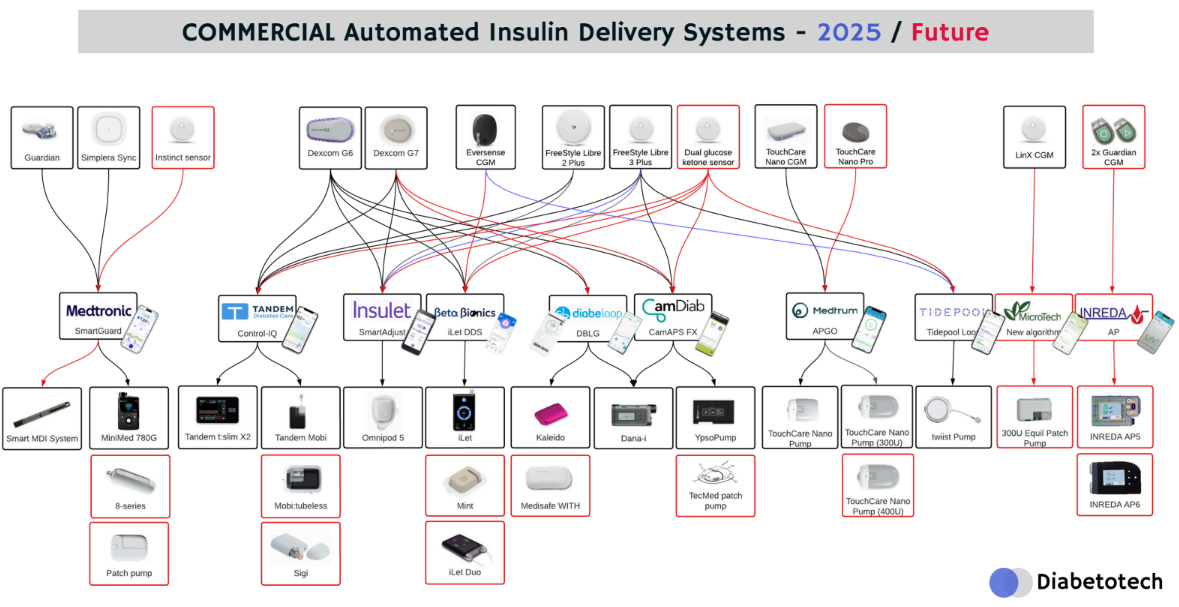

To download our updated diagrams as a pdf, click here.

The main players remain Medtronic (now MiniMed), Tandem, and Insulet, with a lot of new systems gaining traction.

Across the board, manufacturers are working toward:

- Patch pump options

- Full phone control

- And algorithms that can dose without meal boluses – making systems easier to use.

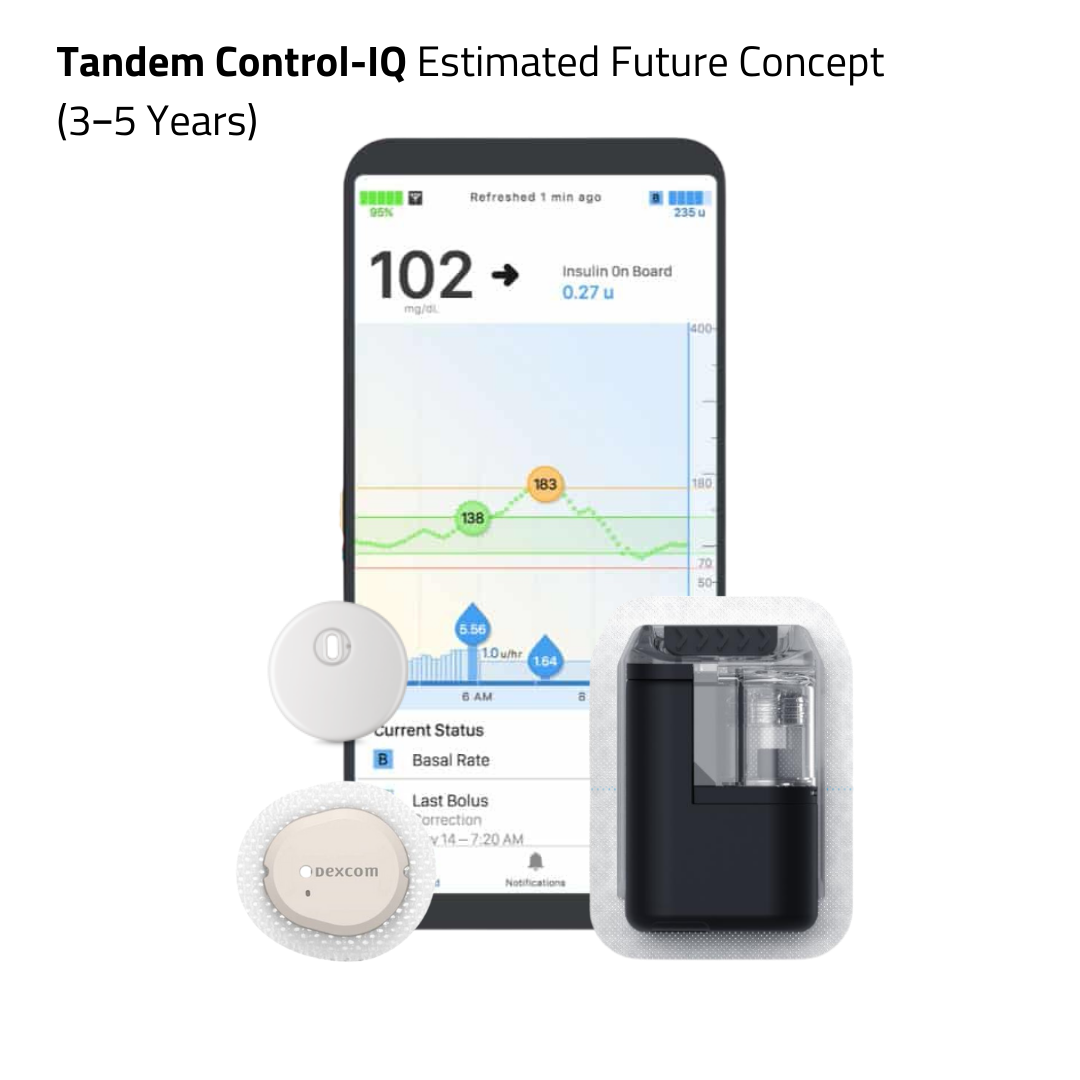

Here’s how the available closed-loop systems might look in 3-5 years from now:

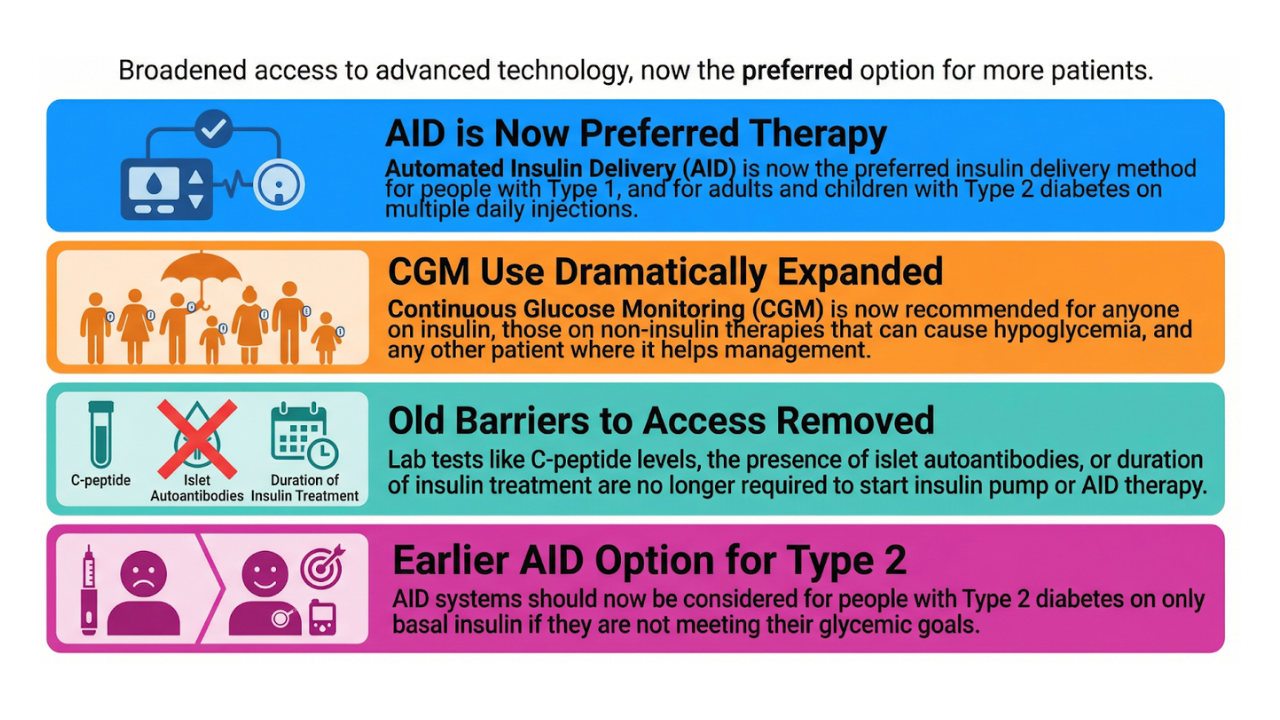

While most closed-loop systems today still require tubing and bolusing for meals, their proven benefits have led to recommendations for people with both type 1 and type 2 diabetes on intensive insulin therapy. Some systems (like Omnipod 5) are even FDA-approved for people with type 2 diabetes on basal-only insulin.

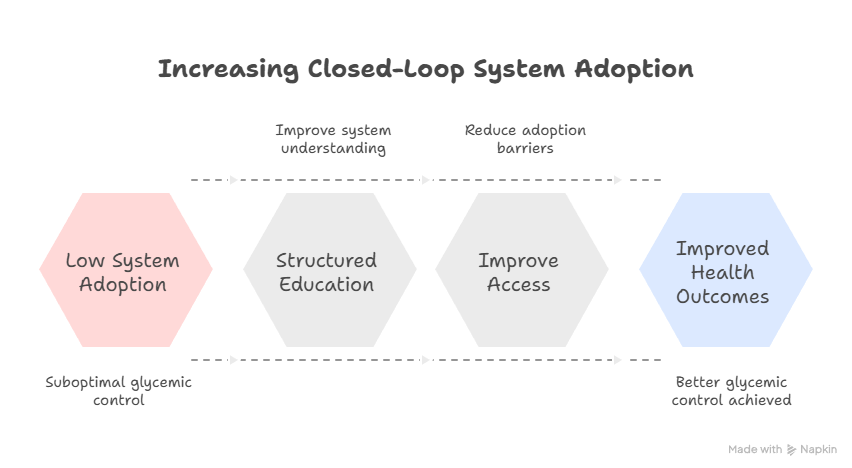

Yet, as the recent JAMA Network Open study shows, adoption of closed-loop systems remains too low:

in 2021-2023, only 47% of children and 22% of adults with type 1 diabetes in the US were using a CGM together with an insulin pump.

This helps explain why the majority of people with type 1 diabetes still have suboptimal glycemic control:

only 19% of youth and 28% of adults achieve an HbA1c below 7%.

At the same time, health-economic evidence from Spain highlights that closed-loop systems not only improve HbA1c by an estimated 1.5% compared to CGM + pump therapy,

but also double long-term survival and save nearly €29 million per 1,000 patients through avoided complications.

The implication is clear: we already have the tools to change the trajectory of type 1 diabetes, but access and adoption remain the major barriers.

Wider adoption—supported by structured education—could transform both individual lives and healthcare systems.

Here’s where you can access structured education:

- YouTube – Free videos; full library available via YouTube Membership.

- Website – Structured e-learning with transcripts, downloadable resources, certification, and EACCME accreditation. Earn up to 34 CME points; team memberships available.

Kind regards,