2025 in Diabetes Technology: Promises vs. Reality

Jan 09, 2026

Every year, diabetes technology arrives with bold claims.

This year will be the breakthrough.

This system will change everything.

2025 was no exception—but this time, a surprising number of promises actually translated into real-world change.

Below is a clear-eyed recap of what truly moved the field forward in 2025—and what mattered.

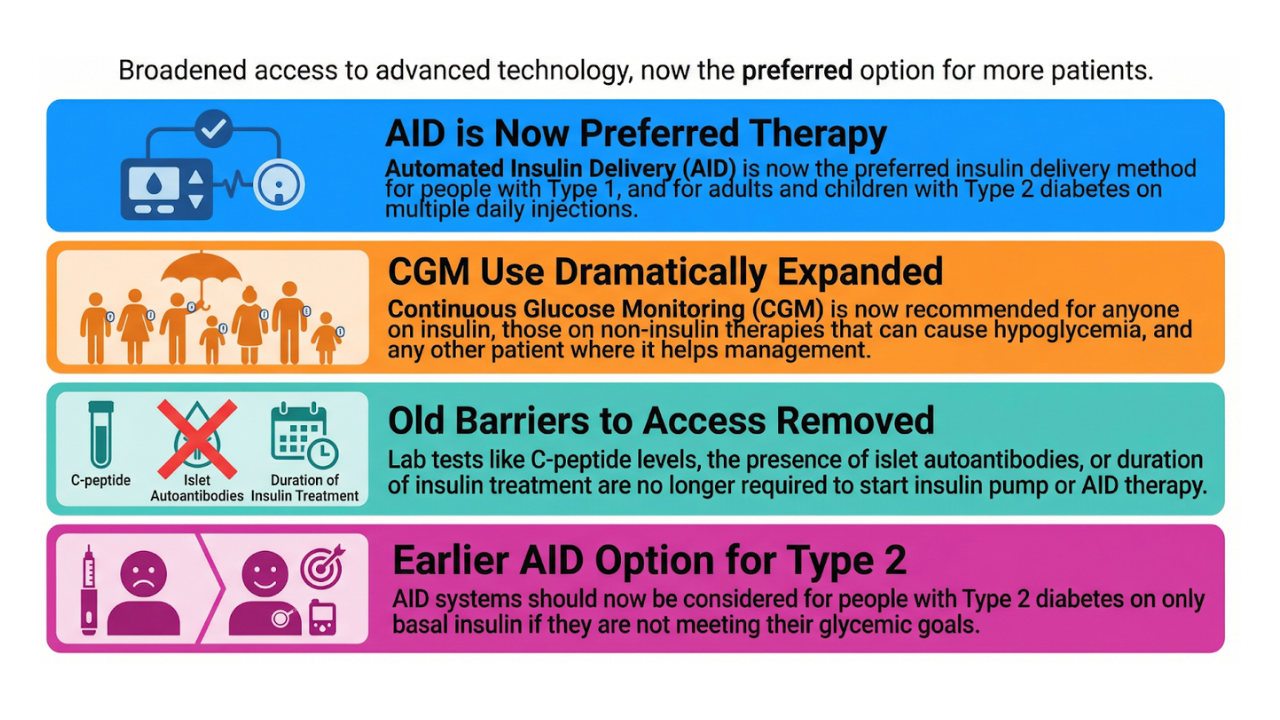

Automated Insulin Delivery (AID)

MiniMed 780G

- 5-2025: Medtronic announced plans to separate its diabetes business into a new, standalone, publicly traded company, branded MiniMed, with a target timeline of ~18 months.

- 7-2025: CE-label expanded to include type 2 diabetes, children ≥2 years, and pregnancy.

- 9-2025: FDA cleared MiniMed 780G for integration with Abbott’s Instinct sensor and approved use in adults with insulin-requiring type 2 diabetes.

- 9-2025: Simplera Sync and Instinct sensors launched in the US (Europe still awaiting Instinct).

Tandem Control-IQ

- 2-2025: FDA label expanded to adults with type 2 diabetes.

- 3-2025: US launch of Control-IQ+.

- 8-2025: FDA label for 7-day SteadiSet infusion set.

- 9-2025: FDA approval of Lyumjev for use with t:slim X2 and Control-IQ+ (previously approved in Europe).

- 10-2025: Libre 3 Plus connectivity with t:slim X2 in the US.

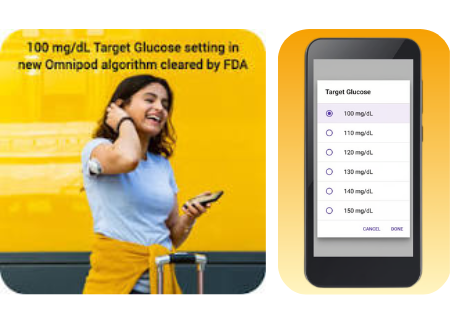

Omnipod 5

- (Already FDA-approved for adults with type 2 diabetes.)

- 2025: Rapid international rollout.

- 2025: Launch of Omnipod Discover, Insulet’s proprietary data visualization and readout platform.

- 11-2025: Compatibility of LibreLinkUp app with Omnipod 5

- 12-2025: Integration with Dexcom G7 15 Day.

- 12-2025: FDA approval of a new 100 mg/dL (5.6 mmol/L) glucose target.

mylife Loop / CamAPS FX

- 3-2025: CamAPS FX finally arrived on iPhone.

- 8-2025: mylife Diabetes Care sold to TecMed.

Diabeloop

- 7-2025: Dana-i pump connectivity (Germany).

- 8-2025: CE-label and pre-launch of DBLG2 as a standalone Android app with Kaleido pump.

- 12-2025: FDA clearance for DBLG2 from 12+ years old

iLet Bionic Pancreas

- 1-2025: Beta Bionics completed its IPO, with shares beginning to trade on Nasdaq on January 30, 2025, under the ticker BBNX.

- 12-2025: Approval of Dexcom G7 15 Day integration.

twiist AID System

- 7-2025: US launch on iPhone with Libre 3 Plus.

TouchCare Nano System

- Broader availability, but still limited independent clinical data.

- Ongoing legal disputes with Insulet

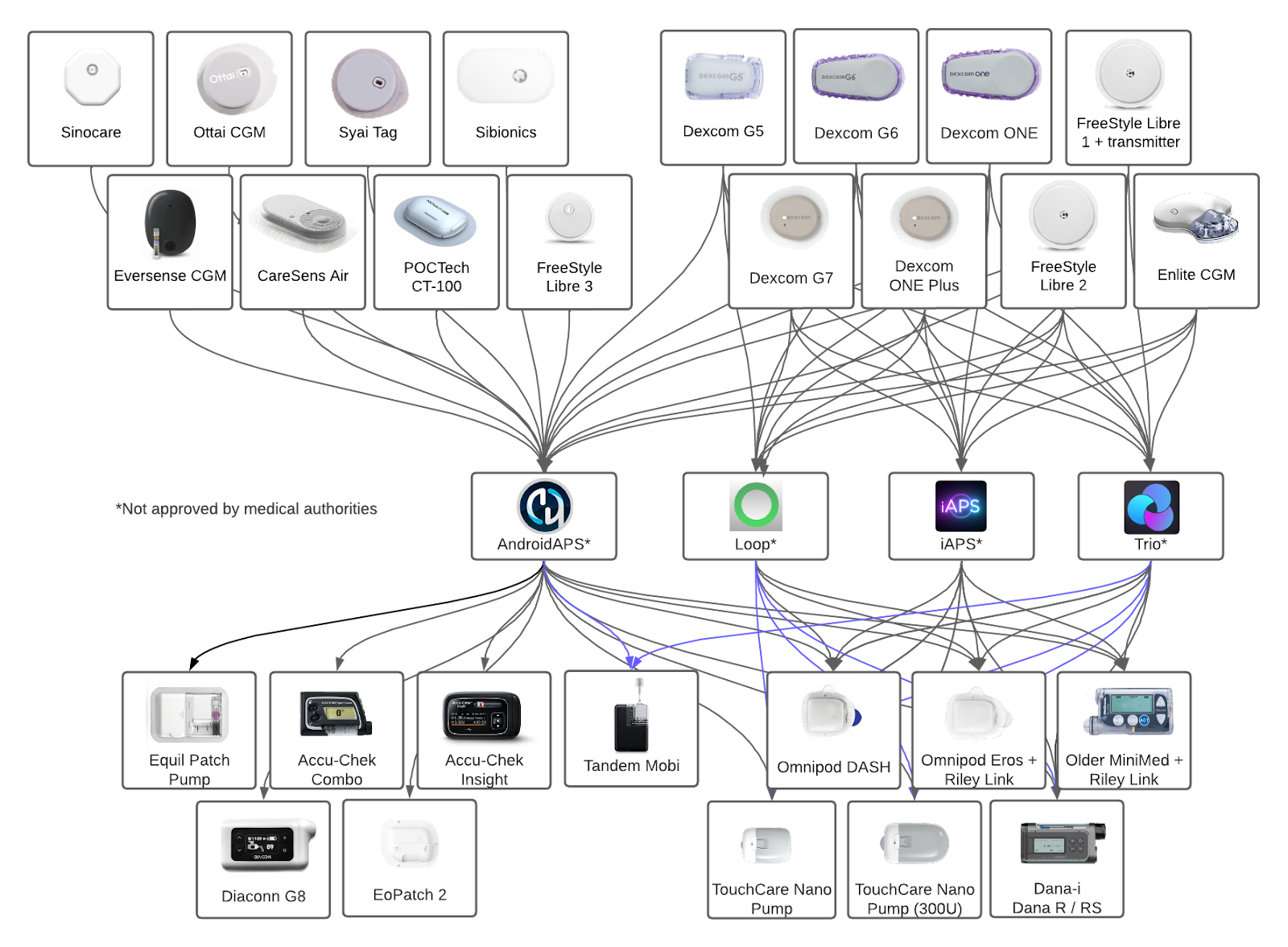

Open-source AID Systems (AndroidAPS, Loop, iAPS, Trio)

- Systems can now be built directly in a phone browser—no PC required.

- AndroidAPS: Added connectivity with Sibionics and Sinocare CGMs; Syai Tag added as a trusted BG source.

- DIY Loop, iAPS & Trio: Added connectivity with Dana-i and TouchCare Nano pumps.

Continuous Glucose Monitoring (CGM)

Abbott

- 4-2025: Unified “Libre by Abbott” app replaced FreeStyle Libre 2 and 3 apps in the US.

- 11-2025: Abbott issued a US device correction for specific Libre 3 and Libre 3 Plus sensor lots due to risk of falsely low glucose readings. The issue was traced to a manufacturing defect affecting a defined production line, allowing affected lots to be identified and replaced.

- 12-2025: Launch of Libre Assist (AI-based food analysis) and a native Apple Watch app for the Libre by Abbott iOS app.

- 2025: Transition from Libre 2 & 3 to Plus versions in major markets (US & UK).

- 2025: Lingo expanded to Android and retail distribution (Amazon → Walmart → Walgreens).

Dexcom

- 3-2025: FDA clearance for Signos, allowing integration of Dexcom Stelo glucose data with behavioral AI coaching to deliver personalized, real-time lifestyle recommendations for adults not on insulin.

- 3-2025: Dexcom received an FDA warning letter stating that a sensor component/material used in Dexcom G6 and G7 had been changed after initial FDA clearance without submission of a new premarket notification. According to the FDA, sensors incorporating this change demonstrated different performance characteristics compared with the originally approved version. Dexcom responded that the modification involved qualification of an alternative material supplier to ensure manufacturing continuity and that internal testing did not show a clinically meaningful impact, while committing to work with the FDA to resolve the issue.

- 4-2025: FDA clearance for Dexcom G7 15 Day (adults ≥18 years).

- 5-2025: “Meals” and “Glucose” features launched in the Oura iOS app, based on Stelo glucose data.

- 6-2025: Multiple FDA Class I recalls and safety corrections affecting Dexcom G7 receivers and apps, mainly related to alarm and alert failures. Public MAUDE reports included reported deaths temporally associated with G7 use, and legal claims were filed, although regulatory authorities have not established confirmed causality.

- 7-2025: Smart Food Log (photo-based meal scanning) launched in Dexcom G7 and Stelo apps (iOS & Android).

- 11-2025: FDA label for Smart Basal (once-daily basal dose recommendation for people with type 2 diabetes starting insulin glargine U100).

- 12-2025: US launch of Dexcom G7 15 Day.

- 12-2025: Announcement that Dexcom G6 manufacturing will end on July 1, 2026.

Roche Diagnostics

- Steady global rollout of Accu-Chek SmartGuide CGM.

- 9-2025: CE-label for mySugr integration.

Senseonics

- 2-2025: Eversense 365 submitted for CE-mark approval (decision pending).

- 9-2025: Ascensia Diabetes Care and Senseonics signed a memorandum of understanding to transfer global commercial operations and distribution of Eversense back to Senseonics starting from 1 January 2026.

i-SENS

- 3-2025: CE-label for upgraded CareSens Air (optional calibration, 30-minute warm-up).

- 11-2025: Global launch of CareSens Air Receiver

Sibionics

- 3-2025: Launch of GS3 (ultra-thin CGM).

- 3-2025: Launch of KS3 (continuous ketone monitor).

- Ongoing legal disputes with Abbott.

Sinocare

- 7-2025: CE-label for iCan i6.

- 8-2025: Strategic withdrawal of iCan i3 FDA submission to focus on iCan i6.

- Ongoing legal disputes with Abbott leading to the discontinuation of the GlucoMen iCan in several European countries.

MicroTech Medical

- Rebrand from AiDEX → LinX.

- Global expansion of LinX CGM.

- Launch of 300 U Equil S insulin pump.

- Known legal disputes with Abbott.

Others worth noting

- Syai Tag: Smaller model launched.

- Ottai: Asia-focused, retail-first CGM strategy.

- Yuwell: Expansion of Anytime CGMs in the UK and Asia.

- Bionime: Entry into veterinary CGM.

- Biolinq: FDA-approval for micro-needle based CGM “Biolinq Shine” as glucose-range sensor for adults >22 years with type 2 diabetes on insulin.

CGM Safety Reality Check (2025)

2025 marked a turning point in CGM maturity. As CGMs scaled to millions of users and expanded into retail and lifestyle settings, post-market surveillance became unavoidable. For both Abbott and Dexcom, the safety signals that triggered regulatory action were predominantly hardware-related—linked to manufacturing processes or physical device components—rather than to core glucose algorithms.

Importantly, these events showed that regulatory and safety systems are doing their job. Traceable manufacturing, lot identification, targeted recalls, and direct user notifications enabled timely detection and correction once problems emerged.

Accuracy also came under sharper scrutiny. With CGMs increasingly used for insulin dosing and automated insulin delivery, even small accuracy deviations matter. Variability between sensors, lots, or study designs—long discussed in the literature—became more visible in real-world use, reinforcing the need for standardized, transparent accuracy assessment rather than headline MARD numbers alone.

The key lesson of 2025 is not that CGMs failed, but that they have become safety-critical medical infrastructure. CGMs continue to reduce hypoglycaemia and hyperglycaemia at a population level, but diabetes management remains a delicate balance. Insulin therapy is inherently risky, even with advanced technology, and CGM safety must now be approached with the same rigor expected of any other critical medical system.

The Big Pattern of 2025

Step back, and the signal is unmistakable:

- AID is expanding to more countries internationally and to people with type 2 diabetes.

- CGM is moving into retail and lifestyle ecosystems.

- Connectivity between different pumps and CGMs is expanding.

- Legal and regulatory dynamics are shaping the market as much as innovation.

2025 did not bring one single, disruptive breakthrough. Instead, it delivered momentum and maturity.

CGM is now a well-accepted standard of care and is entering a phase where price, availability, and reliability increasingly influence choice. In contrast, AID systems continue to differentiate on algorithms, features, and ecosystem design, meaning that ongoing and clinically relevant product updates should still be expected.

Ready for 2026

If you want to go beyond headlines and understand how these technologies perform in real-world clinical practice—where they help, where they fall short, and what actually matters for care delivery—this is where we go deeper.

🔗 Go to the Diabetes Technology Expert Platform >>> https://www.diabetotech.com

🎁 20% discount with code START2026

⏳ Valid until 15 January

Fully ready for 2026.

Kind regards,